I’m Gokcan, and this is

Portfolio Activity

— a daily investing journal built for clarity, not noise.

Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

Portfolio Activity

— a daily investing journal built for clarity, not noise.

Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

New here?

Get daily updates delivered straight to your inbox — free.

No spam. Unsubscribe anytime.

Looking for smarter stock screening? Finviz makes it simple to visualize market trends, screen for opportunities, and track performance—all in one place. Whether you're a beginner or a pro, it's one of the most powerful tools out there for turning data into decisions.

Markets look strong, but summer could change that. Trade talks, Fed decisions, and budget fights may put stocks to the test.

Summer’s usually quiet for the markets — vacations, slow news, light trading. But this year? It might be anything but quiet.

Let’s start with the good news. The job market is still solid. The latest employment data showed more jobs were added than expected in May, and wages are growing faster than inflation. That means people are earning more and still spending — which is key to keeping the economy healthy.

That strength has helped the stock market rebound in a big way. Since the low point in April, global stocks have surged nearly 20%. That’s a huge move in a short time. Big tech companies, strong company profits, and some relief in trade tensions have all played a part in pushing markets higher.

But now comes the hard part, keeping that momentum going.

Three big things are on the radar this summer:

- Tariff Deadlines: Some key deadlines on U.S. and China trade policies are coming up in July and August. If those talks go badly or new tariffs are announced, it could spook investors, especially in industries like tech and manufacturing that depend on global supply chains.

- Federal Reserve Decisions: Two months ago, people thought the Fed would cut interest rates in June. Now, most think it will wait until at least September. If the economy slows down and the Fed waits too long to act, the market may not like it.

- Debt Ceiling Drama: The U.S. government is once again close to hitting its borrowing limit. If Congress doesn’t agree on a new budget or raise the debt ceiling by mid-July, we could see government shutdown threats or worse. It’s a messy political fight that could create headlines and volatility, even if the risk of a real default is low.

So what does all this mean?

The stock market has been strong. The economy, while cooling a bit, is still in decent shape. But investors now face a summer full of potential surprises — both good and bad. If those surprises are managed well, the market could keep climbing. But if things go sideways, especially on trade or government spending — we could see a pullback.

For anyone trying to follow the market and make sense of all the noise, this summer is a key moment to watch. The next few months might not decide the whole year, but they’ll definitely set the tone for what comes next.

The U.S. job market remains strong, but hiring is slowing. Wages are rising, yet cracks are forming — and the Fed is watching closely.

The May jobs report gave investors and everyday observers a sigh of relief — but it also left a few warning flags waving.

Here’s what happened: the U.S. economy added 139,000 jobs in May, which was slightly more than economists had guessed. The unemployment rate stayed low at 4.2%, meaning the job market remains in pretty good shape overall. And wages? Still growing faster than inflation. That means most people are slowly gaining more buying power, not losing it to rising prices.

But if you zoom in, the picture isn’t as perfect.

Hiring is clearly slowing. That doesn’t mean a recession is around the corner but it does suggest the hot job market is cooling off. And some parts of the economy are already feeling pressure.

Manufacturing jobs fell by 8,000 last month, likely due to the impact of tariffs. Federal government jobs also dropped by 22,000 — the biggest cut since 2020.

At the same time, certain areas are still adding jobs quickly. Health care added 62,000 positions, and leisure and hospitality, think restaurants, travel, and entertainment gained 48,000. These are signs that consumers are still out there spending, especially on experiences.

There were a few other details worth noting: job numbers from earlier months were revised downward, which suggests the economy hasn’t been as strong recently as we first thought. Also, fewer people are joining the workforce, possibly due to tighter immigration rules.

So where does this leave us?

The labor market is still doing its job: keeping people employed, supporting wages, and helping the economy stay afloat. But the cracks are there, not big enough to panic over, but visible enough to watch closely.

The Federal Reserve, which sets interest rates, probably sees this as a reason to stay patient. The economy is slowing just enough to avoid overreacting, but not enough to warrant emergency rate cuts, at least not yet.

This kind of “slow and steady” data is the sort that markets tend to respect. It gives both investors and policymakers a little more breathing room — as long as the cooling doesn’t turn into something more serious.

Stocks surged nearly 20% since April, but with prices near highs, the rally now needs real strength — not just momentum — to last.

It’s been a strong couple of months for investors. After bottoming out in April, the stock market has come roaring back with global stocks rising nearly 20% and the S&P 500 not far behind. It’s been a powerful rally, driven by a mix of strong company earnings, cooling trade tension, and the simple fact that things didn’t get as bad as many feared.

But now we’re entering a tricky stage: the rally has come far, fast. And the question is whether the market can keep climbing… or whether it’s due for a pause.

What’s been driving the bounce? Start with the tech giants. After a brief dip earlier in the year, companies in information technology, communication services, and consumer discretionary came roaring back. These sectors make up over half of the S&P 500, and when they rise, the whole market tends to follow. Strong earnings — especially from companies tied to AI helped rebuild investor confidence.

Add in the fact that some trade threats have cooled down and the Federal Reserve hasn’t raised interest rates again, and you get a recipe for a strong rally.

Still, there’s a reason to stay grounded. Stock prices are now back near their highs. That doesn’t mean a crash is coming, but it does mean investors may be more sensitive to bad news. When prices are high, it takes stronger earnings and steadier data to justify further gains. If growth slows down or if trade talks stall or rates stay too high for too long, the market may struggle to keep moving up.

For long-term investors, this isn’t necessarily a warning sign. The recent rally was backed by solid reasons, it’s not just hype or hope. But momentum has done a lot of the heavy lifting, and now the market may need something more concrete like continued earnings growth or a clear Fed signal to push to new highs.

The good news? Fundamentals are still decent. The risk? Complacency. When everyone’s feeling good, that’s often when the market gets blindsided.

Big tech powered a strong earnings season, with AI-linked sectors leading. This rally isn’t hype — it’s built on real profits.

Earnings season is over — and it delivered more than most expected. For all the headlines about tariffs, politics, and global slowdowns, U.S. companies quietly posted a strong quarter. In fact, S&P 500 profits grew 12.5% compared to a year ago. That’s no fluke — it’s the third time in four quarters we’ve seen double-digit growth.

But not all sectors shared equally in the gains. The heavy lifting was done by just three: information technology, communication services, and consumer discretionary. These aren’t just random slices of the market — they’re home to some of the biggest and most influential companies, many tied to artificial intelligence, digital platforms, and online consumer spending.

Tech profits jumped 20%. Communication services — think streaming, mobile, and digital ads — surged 33%. Consumer discretionary rose 8%. Together, these three groups now account for more than half the value of the S&P 500. That means when they do well, the whole index tends to rise — and that’s exactly what’s happened.

NVIDIA, in particular, stood out. The chipmaker has become the poster child of the AI boom, and its results helped it briefly reclaim the title of the world’s most valuable company. That kind of market leadership isn’t just about hype — it’s about earnings power.

Meanwhile, the forward 12-month profit outlook for S&P 500 companies just hit a new high. That’s important. It means investors aren’t just buying stocks on vibes — they’re buying on the expectation that profits will keep growing.

Still, it’s not all sunshine. Earnings expectations for 2025 have come down — from 14% growth to around 8.5%. But the 2026 outlook remains solid, suggesting that some of the slowdown may be temporary and tied to short-term tariff and policy effects.

Tariffs and inflation are quietly weighing on manufacturing and housing. The real economy shows cracks, even as markets stay strong.

Everyone likes to talk about the stock market. But what’s happening in the real economy, jobs, housing, and trade often tells the deeper story. And lately, that story is starting to shift.

Start with the job market. It’s still healthy overall, but there’s a clear divide emerging. Health care, hospitality, and other consumer-facing sectors are adding jobs a sign that people are still spending and businesses are hiring to meet demand. But in manufacturing? It’s a different picture. Factories cut 8,000 jobs last month, and it’s hard to ignore the role tariffs may be playing here. Higher input costs and global uncertainty are starting to squeeze producers.

Meanwhile, housing is giving off mixed signals. Sales of existing homes have ticked up slightly, but prices keep rising. That means buyers are still active, but affordability is getting worse. Tariffs on materials and persistent inflation in construction costs aren’t helping and mortgage rates remain high enough to keep many potential buyers on the sidelines.

This is where the effects of tariffs show up in the real world: not just in trade headlines or market sentiment, but in actual business decisions how much to produce, how many to hire, whether to expand or wait.

Inflation hasn’t gone away, either. It’s no longer the headline worry it was last year, but signs of it are still showing in wages, in housing, and in consumer goods. That’s why the Fed is being cautious. It sees the cooling in some areas, but it’s not convinced the fight is over.

All of this paints a picture of an economy that’s still running but under strain. There’s no collapse, but there’s also no sense of ease. Companies are adjusting. Consumers are adapting. And investors should be paying attention to where the pressure is building.

The Fed’s June cut is off the table. All eyes are on September as markets weigh whether the central bank is waiting too long.

Just two months ago, most investors thought the Federal Reserve was about to pivot. The bond market had fully priced in a rate cut at the Fed’s June meeting. Fast forward to now, and that expectation has evaporated.

Inflation is down, yes, but not convincingly. Growth is slowing, but not alarmingly. That puts the Fed in a holding pattern: watching, waiting, and doing nothing for now.

The big question isn’t just when they’ll cut rates, but whether they’ll act fast enough if things turn south. The central bank doesn’t want to risk reigniting inflation by cutting too soon, but it also can’t afford to wait too long if labor softens or corporate earnings start cracking.

That’s why September is becoming the new focal point. The summer may bring more clarity, especially on wages, housing costs, and consumer spending, and that could finally give the Fed the confidence to move. But there’s risk in waiting. By the time the data confirms the slowdown, the market may already be in a vulnerable spot.

We’re in what you might call a “no man’s land” of policy. The Fed is done hiking, but it’s not ready to cut. So interest rates stay high, and businesses, borrowers, and investors are left adjusting to a world where capital isn’t cheap, even as momentum cools.

This tension is being felt across markets. Equity valuations are stretched, and bond yields have eased slightly, but they’re still elevated. The Fed’s message is clear. They need more evidence before they change course. But if they wait too long, they may find themselves chasing the slowdown instead of cushioning it.

For policy-sensitive investors, this is a moment to stay nimble. If the data breaks one way or the other, either stronger inflation or softer jobs, the Fed’s next move could come into view fast. Until then, it’s a game of patience with the clock ticking toward September.

Stocks are strong, but risk is rising too. A balanced mix of growth, value, and bonds can keep portfolios steady through summer shifts.

When the market looks this good on the surface, it’s easy to forget how quickly the tone can change.

Global stocks have recovered sharply over the past two months, but that rebound brings its own risks. Prices are higher, expectations are elevated, and the runway for error is shorter. For investors thinking about how to position their portfolio, this is one of those moments that calls for balance, not bravado.

Right now, equities still deserve a slight overweight in most portfolios. Economic growth continues, corporate earnings are solid, and interest rates — while high — are no longer rising. That’s a good environment for stocks. But within equities, there’s a growing case for balance.

Growth stocks, especially in tech and consumer innovation, have led the rally. They still have earnings power, particularly in areas like AI and digital services. But they’re also priced for perfection. That’s where value stocks come in. Sectors like financials, industrials, and select healthcare names may not move as fast, but they offer more reasonable valuations and some protection if the market rotates.

In other words, this is a time to hold both sides of the barbell — growth for momentum, value for stability.

As for bonds, expectations need to stay realistic. The chances of a major rally in Treasuries are slim without a recession. But that doesn’t make them useless. In fact, with yields still above 4% and inflation cooling, high-quality bonds finally offer meaningful income — and a layer of safety if volatility returns.

Investors also need to keep an eye on cash levels. Sitting on too much dry powder could mean missing out if markets grind higher. But having a small reserve ready gives you options if prices dip or new opportunities emerge.

The real takeaway here isn’t to chase or hide. It’s to stay adaptable. Portfolios don’t need to be dramatic to be effective. A well-balanced mix, a slight tilt toward stocks, and a calm hand on the wheel is often the best way to move through uncertain terrain — especially when resilience and risk are both in play.

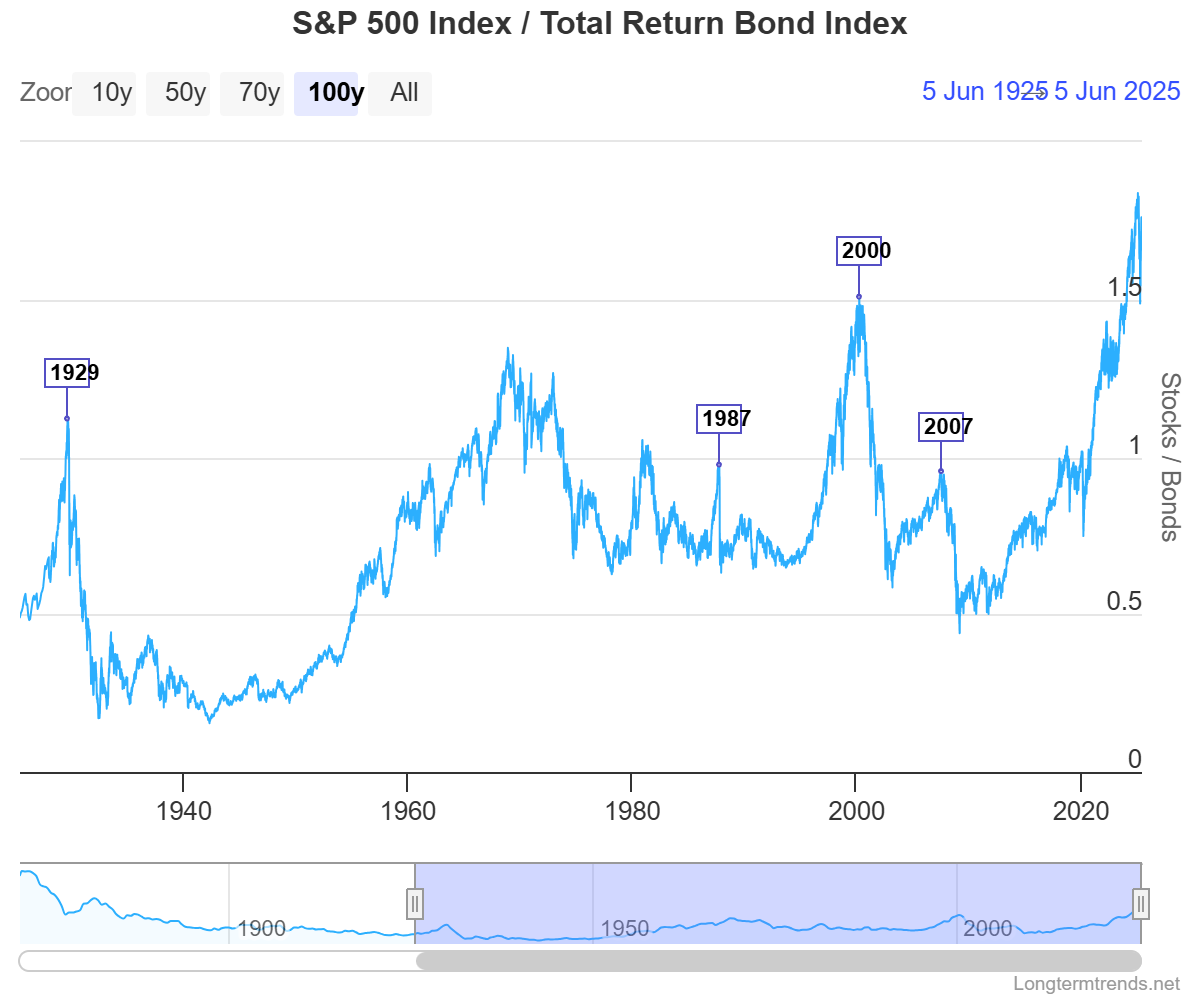

Chart of the Day

- A rising line = stocks are outperforming bonds.

- A falling line = bonds are outperforming stocks.

1929 – Great Depression Bubble

- Massive spike in stock outperformance just before the Wall Street Crash.

- Stocks were dramatically overvalued compared to bonds.

- After the crash, bonds strongly outperformed for years.

1987 – Black Monday

- Short-term peak in stock outperformance.

- Stocks corrected rapidly, but not as deeply as in 1929.

2000 – Dot-Com Bubble

- A major peak: stocks dramatically outperformed bonds.

- After the bubble burst, bonds delivered better returns for nearly a decade.

2007 – Housing Bubble Peak

- A smaller peak compared to 2000, but still notable.

- The Global Financial Crisis followed, and again bonds outperformed in the aftermath.

2024/2025 – Current Levels Near Historical Highs

- Stocks have once again outperformed bonds significantly, approaching dot-com era levels.

- Implies investors are heavily tilted toward equities, potentially overvalued relative to fixed income.

🐂 Bull’s Argument: Optimism With Support

- Job market is still solid, with wages growing faster than inflation — supporting consumer spending.

- Corporate earnings are strong, with S&P 500 profits up 12.5% and forward estimates hitting new highs, especially in AI-linked sectors.

- No recession in sight yet. Economic cracks exist, but the foundation is holding up.

- Fed is done hiking, and a rate cut is likely by September — potentially adding fuel to risk assets.

- Momentum is strong, with stocks rebounding nearly 20% since April, and leadership from tech still intact.

The rally isn’t built on hype — it’s earnings-backed, and as long as the Fed stays patient and consumers keep spending, there’s room to run.

🐻 Bear’s Argument: Fragile Beneath the Surface

- Hiring is slowing and job gains are narrowing to a few sectors — early signs of economic fatigue.

- Tariff risks and debt ceiling drama loom this summer — one bad headline could spark volatility.

- Valuations are stretched, especially in tech — stocks are priced for perfection, which leaves no room for disappointment.

- Real economy cracks are emerging in manufacturing, housing, and government jobs — indicating soft spots beyond the stock market.

- Fed delay risk — if the Fed waits too long to cut, tightening conditions could catch up to markets.

The surface looks calm, but high prices, macro risks, and slowing growth could tip sentiment fast if the wrong catalyst hits.

Extras

Small-cap stocks outpaced large caps last week, hinting at a potential rebound.

Last week marked a notable shift in market dynamics as U.S. small-cap stocks, represented by the Russell 2000 Index, outpaced their large-cap counterparts. The Russell 2000 climbed 3.2%, doubling the S&P 500's 1.6% gain. This performance has sparked discussions among investors about a potential resurgence in small-cap equities.

Historically, small-cap stocks have shown a tendency to outperform in June, with data indicating they have led large caps approximately 60% of the time during this month since 1990. This seasonal trend, combined with the Russell Index's annual rebalancing, often brings increased attention and investment to smaller companies.

Despite the recent rally, small-cap stocks have faced headwinds throughout 2025. The Russell 2000 remains down nearly 6% year-to-date, contrasting with the S&P 500's gain of over 1.5%. Factors such as economic uncertainty, elevated borrowing costs, and concerns over the impact of trade policies have weighed heavily on smaller companies, which are typically more sensitive to domestic economic conditions.

Tesla’s stock has taken a beating this year, dropping 29.3% amid cooling electric vehicle demand and continued drama surrounding CEO Elon Musk. A public feud with President Trump over tax policy didn’t help — knocking an estimated $152 billion off the company’s market cap. However, in a sign that retail support remains strong, shares bounced 5.6% after a wave of individual investor buying. The rebound is notable, but sentiment remains fragile.

Broadcom slightly exceeded expectations with a Q3 revenue forecast of $15.80 billion, but the market wasn’t impressed. Shares pulled back as investors hoped for a more aggressive upside. Still, AI chip sales are on the rise — now expected to hit $5.1 billion — confirming the company’s growing foothold in the semiconductor space. The results show solid execution, even if enthusiasm was muted.

Microsoft shares surged to a record $467.68 this week, reclaiming the top spot in market capitalization — overtaking Nvidia and Apple. The rally was fueled by its $14 billion investment in OpenAI and momentum around Azure, its cloud computing platform. The stock’s quiet strength highlights how Microsoft is positioning itself at the core of the enterprise AI stack.

Amazon announced a $5 billion investment to build AWS data centers in Taiwan, signaling deeper regional expansion. At the same time, the company is trimming operations at home — cutting fewer than 100 roles in its books division to streamline costs. This mix of strategic growth and internal cleanup reflects Amazon’s sharpened focus post-pandemic.

Shares of MongoDB jumped 15% after the company beat Q1 earnings estimates and raised guidance for 2026. Revenue grew 22%, with its Atlas database segment driving much of the momentum. The numbers suggest that despite cloud cost scrutiny, developer tools tied to AI and application performance still have strong demand.

OpenAI: Legal Clouds on the Horizon

OpenAI is appealing a lawsuit from The New York Times related to data use and retention — a case that underscores rising regulatory pressure on the AI industry. As generative AI adoption grows, so does scrutiny, and this legal challenge could become a key test case for how the sector balances innovation with copyright and privacy concerns.

Digital health company Omada Health went public, raising $150 million at a $1 billion valuation. The company’s Q1 revenue jumped 57%, with backing from major VC firms including Andreessen Horowitz and USVP. Its IPO marks a rare win for health tech in a choppy market for new listings.

Walmart is ramping up drone deliveries, expanding to 100 stores even as tariffs and rising input costs push prices higher. The retailer is betting that faster fulfillment can drive loyalty. It also launched a new tween clothing line, targeting a younger demographic amid a competitive retail environment.

Lululemon lowered its full-year profit outlook, citing softer demand and growing competition. Shares slid in response, as investors grew wary of margin pressures from tariffs and a cooling consumer backdrop.

S&P Global upgraded Wells Fargo’s outlook to “positive” after regulators removed its long-standing asset cap. The move has helped shares rise 8.3% year-to-date, signaling renewed investor confidence in the bank’s recovery story.

Interactive Brokers is expanding into 24-hour trading, reflecting rising demand from global and retail investors for round-the-clock access to markets. This shift could further blur the line between traditional and crypto-style trading hours.

Circle Internet, the company behind the USDC stablecoin, went public this week in one of the largest crypto-related IPOs of the year. Strong investor interest marked a turning point for crypto equity listings, even amid ongoing regulatory debate.

Goldman Sachs is shifting its focus toward risk moderation as tariff-related volatility and fiscal deficit concerns weigh on sentiment. The firm is signaling caution after a period of aggressive deal-making and market exposure.

Boeing resumed deliveries of its 737 MAX jets to China following partial tariff rollbacks. The company aims to deliver 50 planes to the region this year — a step toward rebuilding one of its most important commercial relationships.

MP Materials gained 5% after a bullish upgrade from Morgan Stanley. With U.S.–China tensions simmering, the company’s role as a domestic rare earth supplier is gaining strategic importance.

For the sixth straight week, U.S. oil and gas companies have reduced active rigs — even as government forecasts call for rising output in 2025. Operators are trimming activity despite stable prices, opting for capital discipline over expansion.

🔋 Solar Subsidies in Question:

U.S. regulators proposed ending key subsidies for solar leasing companies, which could reduce installations by up to 40% if enacted. The move is part of a broader debate about how clean energy should be financed as costs rise and incentives change.

👔 Trump vs. Musk: Feud Heats Up

President Trump publicly criticized Elon Musk over disagreements tied to a new tax-cut bill. The political feud added to Tesla’s volatility and has become yet another distraction for the EV maker as it tries to stabilize operations.

💸 GOP Budget Passed:

Congress approved a Republican-backed budget package, with key provisions that could reshape spending on renewable energy and widen the deficit. Investors are watching closely to gauge long-term impacts on tax policy, energy markets, and infrastructure funding.

📊 Regulatory Heat on Musk Intensifies:

U.S. regulators are stepping up investigations into Elon Musk’s ventures, adding scrutiny around disclosures, market conduct, and governance. The pressure may become a persistent overhang on Tesla, SpaceX, and other Musk-led companies.

📬 Share this with a friend — and let them in on the secret. They can subscribe right here.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments