I’m Gökcan, and this is Portfolio Activity — a personal, independent, and subscriber-supported investing journal. Each day, I break down the key market moves, big-picture insights, and the smartest perspectives from across the investing world — and then share my take.

—Data center construction alone added a full percentage point to GDP growth.

That’s wild. It’s not just a tech sector phenomenon anymore; this AI wave is spilling into real-world infrastructure at a scale big enough to move national output.

What’s crazy is that this isn’t future-facing optimism—it’s already showing up in the numbers. Steel, cement, transformers, HVAC, power lines… it’s all being laid down right now to support the next generation of compute.

It’s becoming clear that the AI boom is as much a construction and energy story as it is a chips-and-software one.

I’ll be watching the companies building the plumbing behind this shift just as closely as I watch Nvidia or AMD.

Feels like a second-order trend that still isn’t fully priced in.

—The GDP Glitch: Was It Just Imports?

GDP numbers hit again Thursday. That first estimate showed a –0.3% contraction, which definitely raised eyebrows, but the market didn’t fall apart over it. I didn’t either. Most of that drop was blamed on a spike in imports—companies scrambling to get goods in before tariffs took effect. It felt more like a distortion than a genuine sign of slowdown.

Still, a negative GDP print isn’t nothing.

Analysts are expecting no change, but that’s exactly what makes it tricky. Surprises, even mild ones, can catch investors flat-footed.

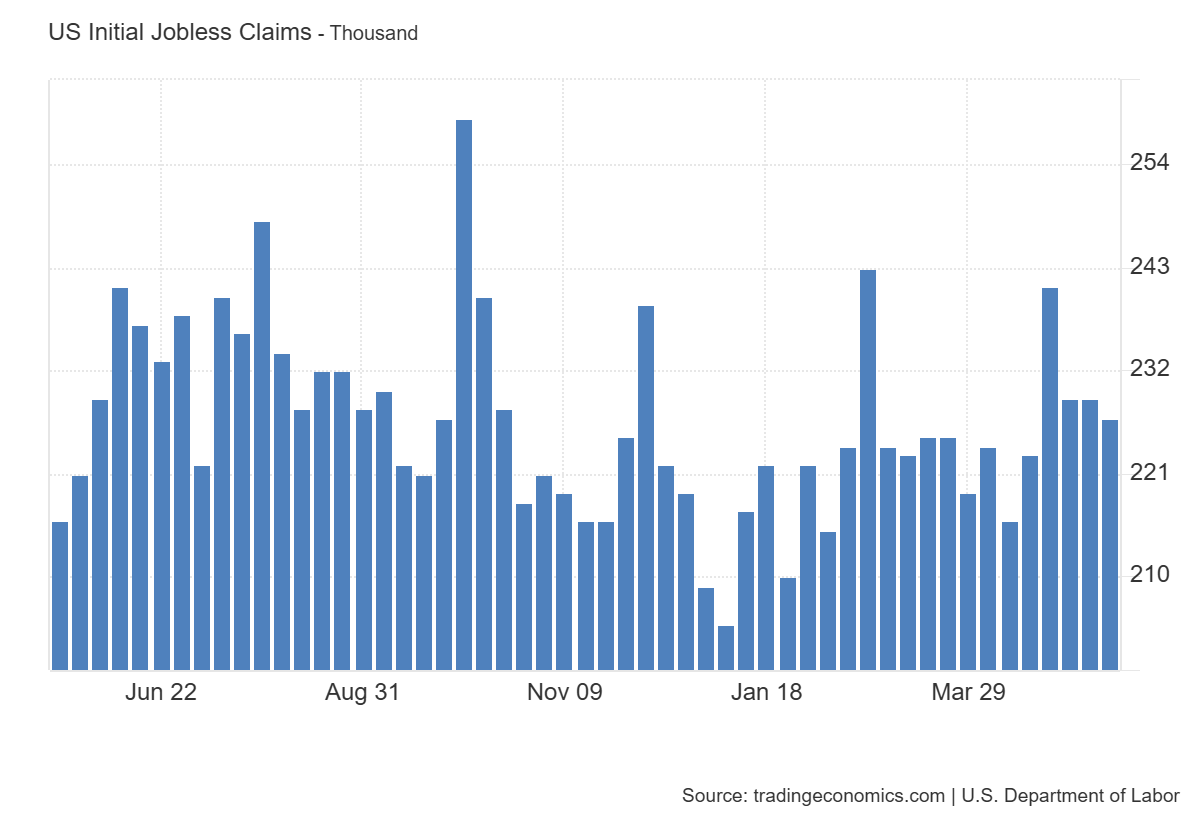

Jobless claims come out the same day, with expectations sitting around 230,000.

That number’s held up pretty well recently, even with all the trade tension and growth anxiety in the background.

To me, it feels like companies are holding their breath not hiring aggressively, but not laying people off either. After everything they went through trying to rebuild workforces post-COVID, it makes sense they’d be slow to cut heads unless they really had to.

But if that claims number starts climbing in the next few weeks, that’s going to be an early sign that businesses are flinching. I’m actually more interested in what comes next Tuesday the job openings data.

If companies are scaling back on hiring plans as tariffs pick up and uncertainty rises, that’s when I’ll start to get concerned about the labor market’s resilience.

Right now, it’s less about any one number and more about the direction they’re all pointing.

It makes me want to stay cautious, keep risk exposure light, and watch closely how the Fed reacts.

—Nvidia’s Big Quarter

Nvidia technically missed earnings this quarter, which you don’t expect from a company that’s been the poster child of the AI boom.

The EPS came in light—but that was because of a $4.5 billion charge tied to China’s H20 export restrictions. On paper, that’s a miss. But the stock moved higher after hours anyway. That tells me the market isn’t in denial it’s staying focused on the long game.

Revenue came in at $44.1 billion, beating expectations. Even with China dropping out of the picture (a potential $8 billion hit), the overall outlook held steady. That’s a strong sign that Nvidia is managing through geopolitical friction without losing momentum.

It’s not avoiding the damage from China it’s just outmaneuvering it.

Margins were actually the most encouraging part of the report. Reported gross margin was 61%, but strip out the write-down and it would’ve been 71.3%—which is basically back in the comfort zone.

That tells me the Blackwell ramp is going better than expected. And it’s already showing up in the numbers: data center revenue was up 73% year-over-year, with hyperscalers (Microsoft, OpenAI, etc.) deploying Blackwell systems at scale.

What’s even more important is the story Nvidia’s starting to tell now. Jensen Huang is shifting the narrative from just training big models to something broader sovereign AI and enterprise infrastructure. Countries like the UAE and Taiwan are ordering AI capacity by the gigawatt. Enterprises are starting to test out AI factory concepts.

That won’t immediately replace hyperscaler demand, but it gives Nvidia new verticals to grow into.

They also talked a lot about inference the idea that we’re moving past training into deployment, running AI models live, and at scale. That’s a different type of demand profile: more continuous, more enterprise-focused, and potentially more durable. It’s also a direct rebuttal to the “peak AI” crowd that thinks the buildout is over.

From what I can see, it’s not over, it’s just shifting gears.

China’s still a problem.

Nvidia openly said it might lose access to that $50 billion market completely. Whether their stripped-down chips will get approved or sell well is still a question.

But I have to give credit here: absorbing that kind of geopolitical hit and still projecting $45 billion in revenue next quarter is no small feat.

No, the stock probably won’t go vertical again like last year. Growth is going to slow down from here—it has to. But what I take away from this quarter is that Nvidia is now big and diversified enough to take punches and keep moving forward. The AI wave is still real. It’s just entering its next phase and Nvidia’s still leading.

What I’m watching next:

For now, the market’s giving them the benefit of the doubt. But it’ll take continued proof, quarter after quarter, to keep the story intact.

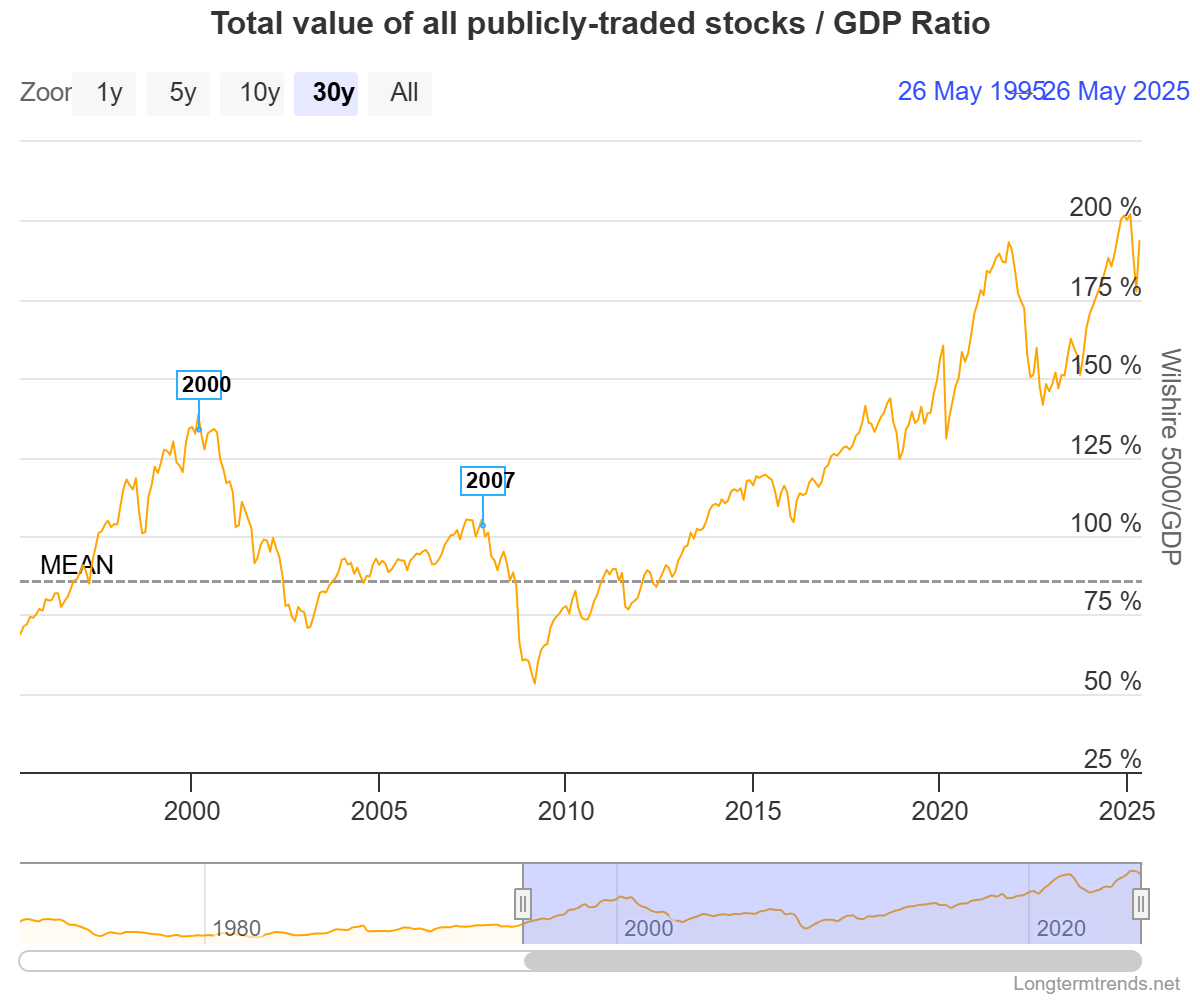

—Today's Chart

- Long-Term Mean: Historically, the ratio hovered closer to 75–100%, indicating balanced valuations.

- 2000 Dot-Com Peak: Around 145% — considered extreme at the time.

- 2007 Pre-Financial Crisis: Hit ~105%, which was still elevated.

- Current (May 2025): Near 175%, down from a recent high above 200% — still significantly over the historical average.

We’re still in stretched valuation territory. Despite short-term corrections, the market remains priced for perfection relative to GDP. This doesn't predict a crash, but future returns are likely to be modest unless justified by explosive earnings or GDP growth.

Smart investors should focus more on selectivity and less on index-level momentum. Mean reversion may be a question of when, not if.

—Trump Admin Tells U.S. Semiconductor Designers to Halt China Sales

—FOMC Minutes: Growing Uncertainty and Trade-Off Risks

—OPEC: Production Levels Reaffirmed Through 2026

—Company Spotlight

Suppliers ramping up Blackwell AI server production

Nvidia’s new Blackwell architecture is already scaling aggressively—reinforcing its central role in AI infrastructure. As demand moves from hype to deployment, this supports Nvidia’s future revenue trajectory and shows confidence from the supply chain. It’s a clear signal that the AI buildout is still very much alive.

Surging power demand from data centers

A highly telling sign of the AI energy bottleneck. Massive power requirements from AI and cloud workloads could reshape utility and infrastructure investment themes. Utilities are becoming the picks-and-shovels trade for the AI economy.

Apple is planning a dedicated app for video games

Apple entering gaming with a standalone app could signal a pivot toward deeper monetization of the gaming vertical—an area where it’s underpenetrated despite massive hardware reach. It opens a door to higher ARPU and more content leverage across platforms.

Trump aims to take Fannie Mae public.

Reviving privatization efforts for Fannie and Freddie would shake up the mortgage finance market and potentially unlock value for long-dormant equity holders. This is a politically sensitive but financially explosive development if it gains traction.

GameStop bought 4,710 Bitcoin

It marks a re-entry into speculative territory by a meme stock with a strong retail following. While it may not have balance sheet significance, it signals potential sentiment shifts in the crypto/meme stock crossover crowd. Could spark renewed volatility and retail-driven activity.

Honeywell to add Elliott exec to board.

A signal that activist involvement is growing in industrial giants. Often a precursor to operational shifts, asset divestitures, or cost-cutting. Could lead to strategic changes or capital allocation improvements.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments