I’m Gokcan, and this is — a daily investing journal built for clarity, not noise. Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

Looking for smarter stock screening? Finviz makes it simple to visualize market trends, screen for opportunities, and track performance—all in one place. Whether you're a beginner or a pro, it's one of the most powerful tools out there for turning data into decisions.

📌 QuickTakes

- QQQ tests critical resistance: A potential triple top is forming near $537. Failure here could shift sentiment from “buy-the-dip” to “watch-the-breakdown.”

- Inflation cools again in May: CPI and Core CPI came in below expectations. Services inflation is stabilizing, supporting soft-landing hopes.

- Tariff tensions ease—for now: U.S. and China reach draft trade deal. The July 9 deadline could still reintroduce volatility.

- AI capex is surging, but so is depreciation: Tech giants like Amazon and Meta are sacrificing buybacks for infrastructure. Investors are starting to ask: what if the payoff doesn’t come fast enough?

- Q2 earnings setup looks primed for upside surprises: Expectations are low, valuations are high, and market reactions—not results—may define the next move.

- Europe joins the AI race: NVIDIA expands its footprint and signals interest in quantum computing, hinting at future tech leadership beyond AI.

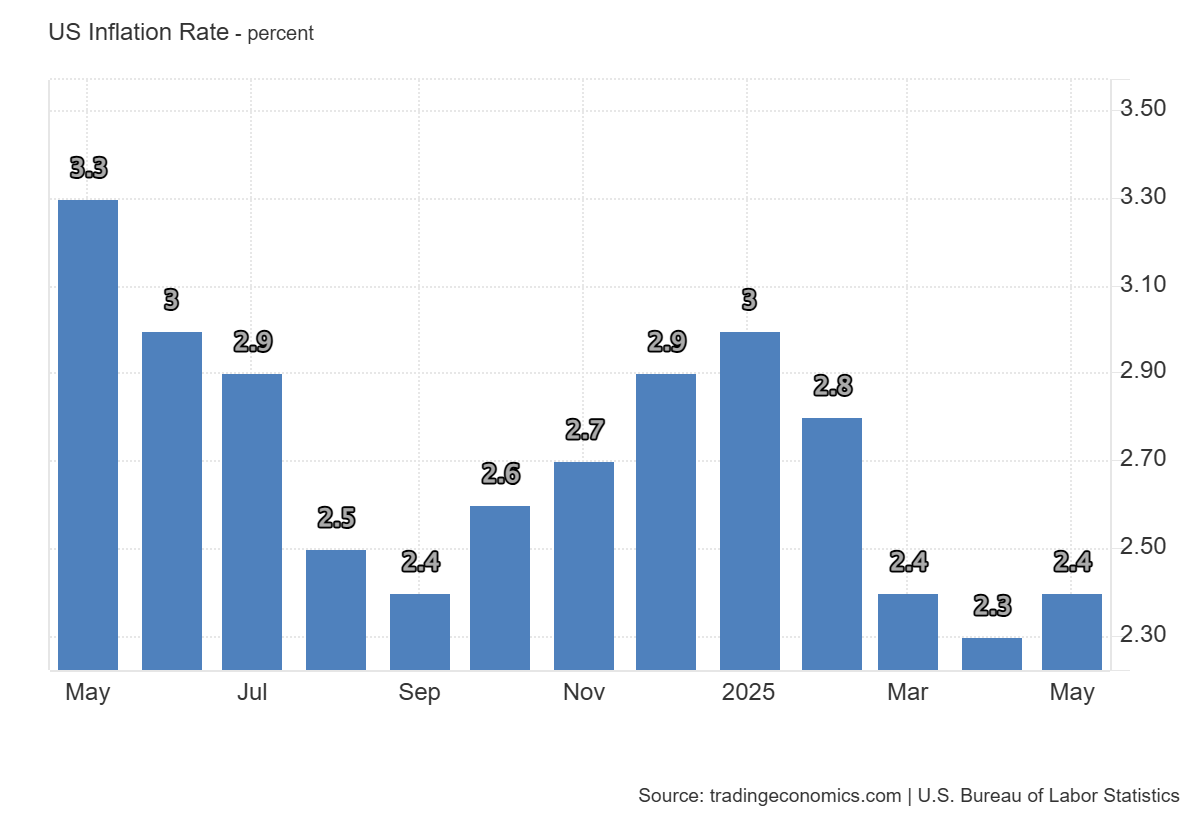

Inflation cooled in May, with CPI and core both below forecast. Tariff impacts are muted for now, but risks could reemerge.

The May inflation report brought more welcome news for markets. Both headline and core inflation came in cooler than expected, a trend that’s beginning to look durable. Headline CPI rose just 0.1% in May, pulling the annual pace down to 2.4%. Core CPI, which strips out food and energy, also eased, up only 0.1% month-over-month and 2.8% year-over-year.

Digging deeper, the real story was in services. Core services inflation rose 0.2% for the month and 3.6% from a year ago matching April’s reading and marking the slowest pace since November 2021. In a services-heavy economy, that’s meaningful. It suggests inflation pressures from labor and housing may be starting to stabilize.

Core goods inflation, which is often where tariffs show up first, was flat on the month and up just 0.3% over the past year. So far, there's little evidence that higher import costs are being passed through to consumers.

But the tariff risk isn’t gone, it’s just delayed. Businesses may be absorbing those costs for now, banking on the hope that recent trade de-escalation continues and tariff rates eventually fall. If tensions rise again, though, pricing power could shift, and that calm may not last.

As for the Fed? This report keeps them on track for easing later this year, but probably not aggressively. One or two rate cuts in the second half of 2025 still looks like the base case. The Fed will want more evidence that inflation is cooling without damaging the labor market before pulling the trigger.

All in, May’s numbers offer another signal that inflation is trending in the right direction even if the bigger picture still carries trade-related risks. For now, markets are getting the soft landing they hoped for. But staying there will require both policy and global trade dynamics to keep cooperating.

Trade tensions cool as U.S. and China reach a draft deal. Markets rebound, and equities look better positioned than bonds for now.

Progress, finally.. or at least the promise of it.

After two days of closed-door negotiations in London, U.S. and Chinese officials appear to have reached a handshake agreement to ease some trade restrictions. The framework is still vague, and it will need final approval from President Trump and President Xi, but the direction is clear: cooler heads are starting to prevail.

Initial reports suggest the U.S. may scale back export controls on certain tech goods in exchange for Chinese access to rare-earth minerals. That would mark a strategic shift from broad-based tariffs to more targeted, sector-specific trade-offs, a move that could reduce uncertainty for key industries like semiconductors and clean tech.

Still, tariffs aren’t going away entirely. The new baseline rate for Chinese imports is expected to be 55%, a combination of the 30% hike earlier this year and the legacy 25% duties. It’s a high number, but stability and clarity might matter more to markets than the headline rate itself.

Equities seem to agree. The S&P 500 is now roughly 2% off its all-time high set in February, regaining ground as trade risks ease and economic data holds firm. In short, we may have passed the peak of trade-policy uncertainty.

That said, we’re not in the clear yet. The temporary pause on tariffs that began in April expires on July 9, and as that date nears, volatility could creep back in. Any delays in implementing this new framework, or unexpected pushback from either side, could rattle sentiment again.

Still, with macro data showing resilience and policy headwinds beginning to fade, the setup favors stocks over bonds for now. Within equities, the U.S. continues to offer stronger earnings stability and relative clarity compared to international peers.

This isn't the end of the U.S.–China trade story, but it might be the start of a more predictable chapter and that’s something investors can work with.

With Q2 earnings forecasts falling, the bar is low. That could set the stage for surprise upside if companies deliver again.

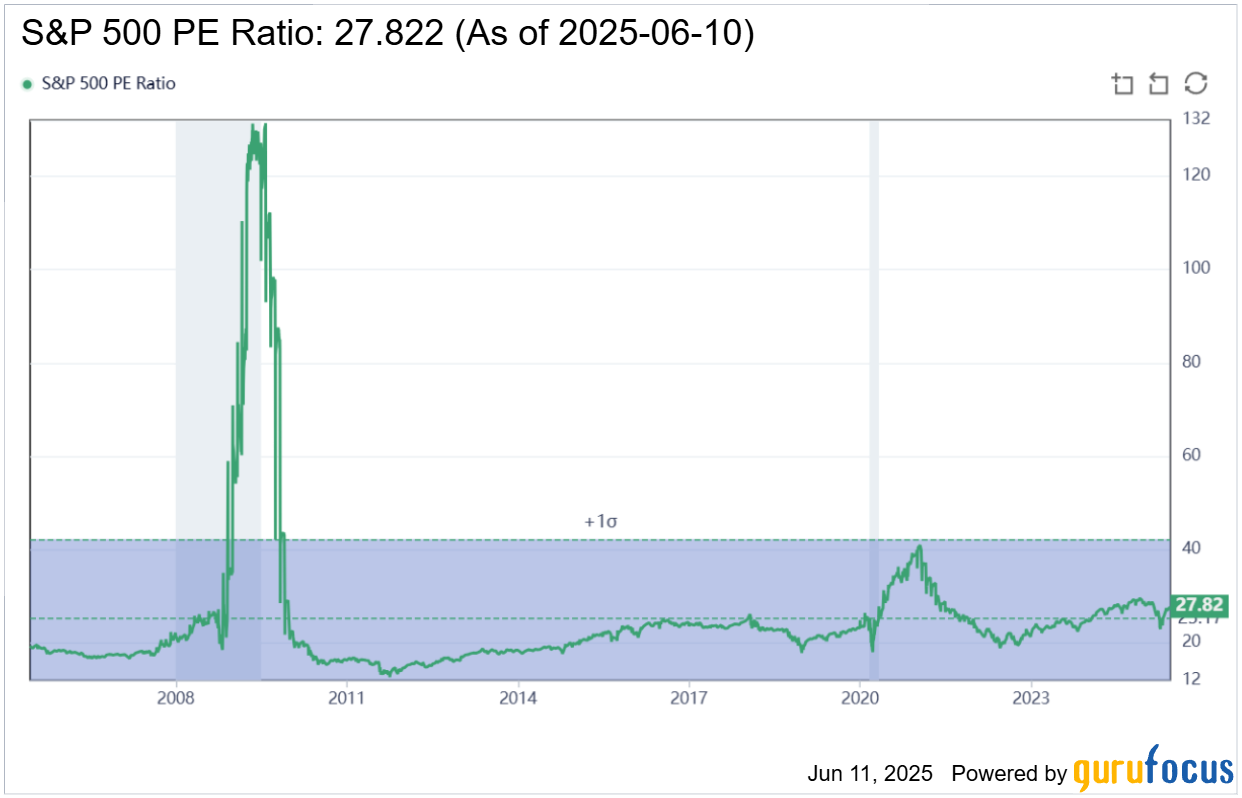

S&P 500 PE Ratio was 27.82 as of 2025-06-11, according to GuruFocus. Historically, S&P 500 PE Ratio reached a record high of 131.391 and a record low of 5.31, the median value is 17.957. Typical value range is from 20.91 to 28.83.

Earnings season is around the corner, and the setup is classic: Wall Street has dialed back expectations, just as stock valuations stay stretched.

Second-quarter earnings growth for the S&P 500 is now pegged at 4.9%, according to FactSet, a big drop from the 13.5% pace we saw in Q1 and well below the 9.3% growth analysts expected at the end of March. That makes Q2 the softest quarter since late 2023.

But here’s the twist: this kind of “lowered bar” environment might actually be good news for stocks if companies can clear it.

Valuations aren’t cheap. The S&P 500’s forward price-to-earnings ratio is back above 21, close to historic highs. That tells us investors are still pricing in future strength. But it also means there's little margin for error. Any disappointment, especially in big names could trigger sharp pullbacks.

At the same time, this setup also creates opportunity. If companies merely beat these softer expectations, especially after last quarter’s upside surprise, we could see another round of post-earnings rallies.

Markets tend to react more to expectations than actual results. And right now, the narrative has shifted from “booming profits” to “just don’t blow it.” That shift might be just what’s needed to allow room for a few upside shocks.

The takeaway? Keep your eye not just on earnings reports, but on reactions. With expectations reset, the real story this quarter could be in how the market handles “better than feared.”

Today's Story

The biggest names in tech are pouring money into AI infrastructure and not quietly. Alphabet, Amazon, Meta, and Microsoft are expected to shell out a record $311 billion in capital expenditures this year, with forecasts pointing to $337 billion by 2026.

In Q1 alone, capex exploded by more than 60% year-over-year. That’s a massive commitment. But here’s the catch: free cash flow during the same period dropped 23%. It’s a clear disconnect, and it's starting to raise eyebrows.

Behind the spending spree is a race to dominate AI — and that means servers, chips, and data centers. But these aren't long-lived assets like buildings or factories. They're tech infrastructure with short lifespans and high depreciation. And depreciation is quietly snowballing.

Microsoft, Alphabet, and Meta saw combined depreciation hit $15.6 billion in Q1, up from $11.4 billion a year ago. Amazon, meanwhile, has taken a different tack — shortening the lifespan of its equipment to accelerate depreciation, essentially pulling costs forward.

These moves aren’t just bookkeeping. They directly affect earnings, and they signal different strategies around how each company is navigating capex-heavy growth. Some are using accounting levers to smooth the impact. Others are absorbing the hit upfront.

So far, investors aren’t rattled. Since Trump’s tariff pause in April, AI-heavy stocks have surged. Nvidia is up 49%, Meta 38%, Microsoft 33%. Even the S&P 500 is up 21% since then. Market enthusiasm, fueled by scale and balance sheet strength, is still overpowering short-term margin worries.

But there’s a clock ticking. If AI-driven revenue doesn’t ramp as quickly as expected, the math starts to turn against them. At some point, Wall Street will want to see returns, not just investment.

This isn’t just about one soft quarter. The concern is structural. High depreciation, falling free cash flow, and stretched valuations don’t make a great mix if AI adoption stumbles or monetization proves slower than forecast.

The market is betting big on AI. But if the payoff doesn’t materialize soon enough, this spending cycle could turn from strategic to burdensome, fast.

Today's Note

Amazon is replacing buybacks with AI infrastructure bets, signaling a long-term pivot in how tech giants deliver investor value.

Buybacks used to be the headline. Dividends were the signal. For years, shareholder returns meant one of two things: cash in your pocket or fewer shares in the market. But something’s changed and Amazon is making that shift unmistakable.

In 2025, Amazon isn’t just leaning into capital expenditures, it’s redefining them as the primary tool for long-term value creation. This year alone, Amazon’s infrastructure investment will top $50 billion, most of it going straight into the guts of the AI economy: data centers, chips, fiber networks, and power-hungry compute clusters.

Meanwhile, buybacks? Minimal. Dividends? Still nonexistent.

But here’s the catch, markets aren’t punishing the stock. They’re rewarding it. Why? Because the narrative around value has shifted. Investors are increasingly viewing CapEx not as an expense, but as an investment in future dominance. And that’s especially true when the capital is going into foundational AI infrastructure that only a few companies can afford to build at scale.

Amazon’s strategy isn’t isolated either. Microsoft, Alphabet, Meta, they’re all trading cash returns for infrastructure intensity. This isn’t just a quarterly tactic. It’s a structural pivot. And it suggests that in the AI era, ownership of compute, bandwidth, and energy access is becoming the new dividend.

But this shift requires patience and conviction. Free cash flow is falling, depreciation is rising, and earnings metrics are under pressure. Yet Amazon is betting that owning the pipes of the next industrial revolution is worth the near-term pain.

For investors, the takeaway is clear: the old signals of capital discipline are being rewritten. CapEx is no longer just a line item, it’s a strategic statement. The companies that spend now to own the infrastructure layer of AI may be the ones that shape what future cash flows even look like.

Technicals

Trend Overview: Uptrend with Structural Fatigue

The long-term trend in QQQ is still upward, supported by rising 50- and 200-day moving averages. The index staged a powerful rebound since the April low, reclaiming all major averages. However, the move is now bumping against a major ceiling at ~$537, the same level rejected twice before.

This sets the stage for a potential triple top, a historically bearish signal if confirmed.

🔺 Double Top Resistance — Now Turning Triple?

QQQ has made two prior attempts to break above the $537 area — once in February, again in March — and failed both times. The current rally has brought us right back to that same level.

If price stalls again here and fails to break out with conviction, a triple top formation would be in play.

- This is not just a price level — it’s a sentiment ceiling.

- Three rejections suggest that buyers may be exhausted, or that macro conditions aren’t supportive enough to justify higher valuations.

- If the third peak rolls over, it would imply growing resistance to upside momentum, a classic topping signature.

What a Triple Top Could Trigger

If QQQ forms a triple top and then breaks below neckline support (~500–505):

- It opens up corrective downside toward 475–480, possibly the 200-day SMA (~498).

- This doesn’t reverse the long-term trend yet — but it would mark a cooling phase in risk appetite.

This pattern would also shift market tone from buy-the-dip to watch-the-breakdowns.

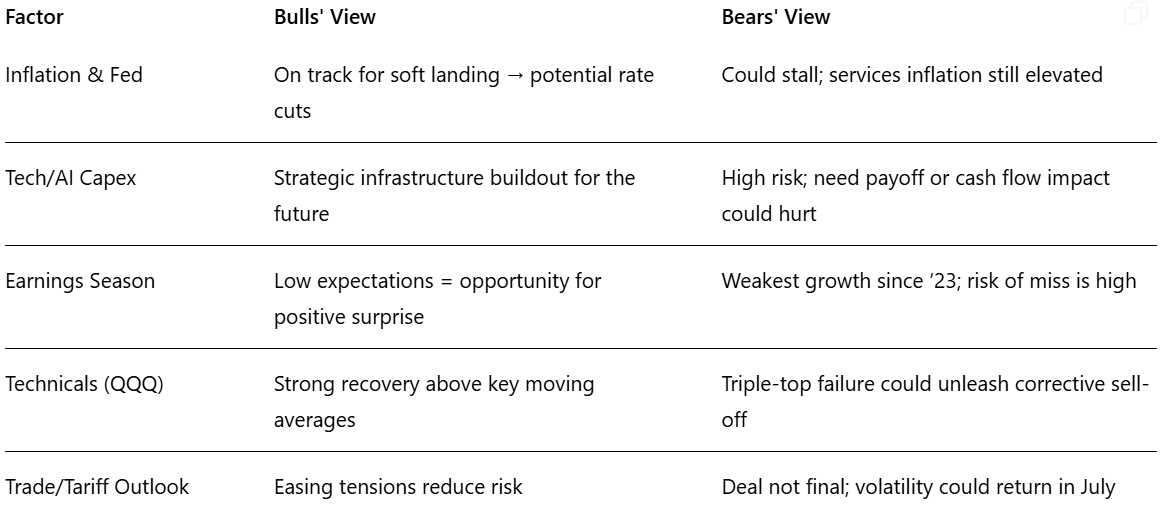

Bulls vs Bears

Extras

NVIDIA is deepening its footprint in Europe as the region commits to building out its AI infrastructure using the company’s technologies.

This development marks a strategic milestone, as it positions NVIDIA at the core of Europe’s next industrial transformation. It also signals that AI infrastructure is no longer just a U.S.-China battleground, it’s becoming a regional economic imperative. For investors, this move reinforces NVIDIA’s central role in global compute ecosystems, extending its influence beyond semiconductors into full-stack industrial development.

CEO Jensen Huang added fuel to NVIDIA’s momentum by declaring that quantum computing has reached an "inflection point." While AI dominates the headlines, this statement hints at NVIDIA’s ambition to shape the next technological wave. If the company is positioning itself early in the quantum race, it may create future optionality in hardware and algorithmic leadership. It also suggests NVIDIA sees quantum as complementary to its AI dominance, not a threat, potentially opening new markets down the line.

Super Micro Computer announced it is expanding its portfolio of systems built for NVIDIA’s Blackwell Architecture into the European market. This expansion aligns with Europe’s infrastructure buildout and further embeds NVIDIA’s ecosystem into next-gen computing solutions. For Super Micro, it strengthens its identity as a hardware backbone for AI.

Watching the supply chain ripple effect of NVIDIA’s growth, this is a signal that second-order beneficiaries are still ramping.

Boeing and Airbus are reportedly in talks for massive aircraft orders that signal renewed strength in aviation demand.

Royal Air is considering a large order split between the two manufacturers, and VietJet is in discussions to acquire 100 Airbus jets. These are not just transactional wins—they shape multi-year backlogs, production schedules, and international airline strategy. With global travel demand recovering, these deals reinforce a cyclical upturn and give tailwinds to a sector that’s been battered and grounded for years.

General Motors is investing $4 billion into domestic manufacturing over the next two years, underscoring its push to modernize U.S. production.

While the headline sounds industrial, it’s deeply strategic: GM is clearly positioning itself to compete in the electric and autonomous vehicle era. With EV incentives, union dynamics, and political pressure swirling, this investment shows GM is betting on vertical integration and American infrastructure to win the next auto cycle.

L’Oréal and NVIDIA are joining forces to “supercharge beauty” with next-gen AI, an unexpected but telling crossover.

This partnership represents how deeply AI is being embedded into even the most consumer-facing industries. From product personalization to digital marketing and R&D, AI is moving from backend optimization to front-end experience. The collaboration speaks to NVIDIA’s expanding moat and L’Oréal’s willingness to lean into future-facing tech—hinting at how AI could soon become a beauty standard, not a novelty.

What to Watch

Here’s a simple breakdown of the major economic updates coming this week:

- June 12: New data on wholesale prices — a key signal of inflation trends.

- June 13: An early look at how confident consumers are feeling about the economy.

- June 16: Japan’s central bank will announce whether it’s changing interest rates.

- June 17: Updates on how much people are spending in stores and how factories are performing.

- June 18: The U.S. Federal Reserve will announce whether it’s raising or holding interest rates. We’ll also get numbers on new home construction.

📬 Share this with a friend — and let them in on the secret. They can subscribe right here.

🔔 Follow us on 𝕏 here.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments