I’m Gokcan, and this is — a daily investing journal built for clarity, not noise. Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

From powerful screeners and heat maps to real-time data and clean visuals, it’s a go-to tool for spotting trends, filtering opportunities, and managing your watchlist. Whether you're a beginner or a pro, Finviz makes market research faster, sharper, and more actionable.

Today's Story

Iran fires 40 missiles at Israel. Israel strikes back, hitting gas and nuclear sites. Oil jumps, and global risk climbs with it.

Tensions in the Middle East reached a dangerous new phase over the weekend as Iran launched at least 40 ballistic missiles toward the Israeli port city of Haifa, prompting a swift and coordinated response from Israel. Civilians in northern Israel were ordered to shelter in place, with early reports pointing to damage across residential and energy infrastructure.

In retaliation, Israel struck Iranian oil depots, gas facilities, and nuclear sites, releasing footage of precision airstrikes on ballistic missile storage units, underground bunkers, and military installations. According to Israeli officials, natural gas infrastructure near Bandar Abbas was deliberately targeted to send a message to Tehran, while other strikes appeared aimed at weakening Iran’s capacity to sustain long-range attacks.

Reports suggest that Israel now claims air superiority over parts of western Iran, allowing it to carry out real-time operations against both fixed and mobile targets. Military sources say that at least 40 Iranian air defense systems have been neutralized so far. Meanwhile, intelligence-driven targeting reportedly led to the deaths of senior IRGC Air Force personnel during a strike on a command center.

Iranian state media, citing Reuters, reported up to 60 civilian deaths, including 20 children, from Israeli strikes. These claims have not been independently verified, but footage from both Israeli and Iranian sources confirms widespread destruction, including fires at nuclear facilities in Esfahan and Natanz. The International Atomic Energy Agency (IAEA) stated that radiation levels remain stable, indicating that while power supplies were affected, underground uranium enrichment bunkers were not breached.

A particularly sensitive target was Iran’s South Pars Gas Field—the largest natural gas field in the world, shared with Qatar. Iranian officials acknowledged a temporary production pause of 12 million cubic meters per day, representing roughly 70% of the country’s domestic gas supply. The energy impact of these strikes is still unfolding, but the market is already responding.

Crude oil markets moved sharply even before the missile exchanges. On Friday, U.S. crude surged over 7%, closing near $83 per barrel, its highest level in four months. With energy infrastructure now under direct attack and natural gas disruptions spreading, the risk of another leg higher remains high.

Investors are increasingly factoring in broader regional instability, including possible U.S. and U.K. military involvement. Reports of RAF coordination, French and British military deployments, and U.S. Delta Force readiness—though not officially confirmed—add to the geopolitical risk premium now embedded in markets.

China and Turkey have condemned the Israeli strikes, while Iran has warned that retaliation could extend to U.S., U.K., and French military installations. These developments suggest a widening conflict, with political alliances and economic consequences spreading beyond the Israel-Iran axis.

This conflict is not just about territory, it is now about supply chains, inflation, and central bank maneuvering. With oil and gas infrastructure under threat, and global commodity prices already elevated, the Federal Reserve may find its path to rate cuts increasingly constrained. Any delay or deviation from the expected policy easing could ripple through equities, credit markets, and currencies.

Stocks slipped Friday as Middle East tensions flared—ending a two-week rally and dragging the Dow down over 1% for the week.

Markets cooled off heading into the weekend and this time, the drag wasn’t economic. It was geopolitical.

A late-week spike in Middle East tensions rattled investor confidence on Friday, sending all three major U.S. indexes lower and breaking a two-week winning streak for the S&P 500 and NASDAQ. The losses were modest, fractional declines for the broader indexes but the Dow Jones finished the week down more than 1%, making it the hardest hit of the three.

This wasn’t about inflation, earnings, or Federal Reserve signals. It was about rising global risk. And that kind of uncertainty tends to show up quickly in equity markets, especially on Fridays, when institutional investors are more likely to trim exposure rather than hold risk over the weekend.

Geopolitical headlines don’t always impact fundamentals, but they shape sentiment. In a market already stretched by valuations and light summer volume, even modest shocks can break momentum.

The message was clear:

Gains can vanish fast when nerves are exposed.

Oil spiked 12% for the week after Israeli strikes in Iran, rekindling inflation worries and complicating the Fed’s path to cuts.

Energy markets didn’t wait for confirmation. U.S. crude oil surged more than 7% on Friday, closing around $83 per barrel, its highest level in four months. The spark? Reports that Israeli military strikes targeted Iranian nuclear sites, an escalation that instantly raised the specter of supply disruptions and geopolitical spillover.

By the end of the week, oil was up nearly 12%, a sharp reversal from recent calm. And while equity markets pulled back on Friday, the oil chart told a bigger story—one of renewed inflation risk just as the Federal Reserve is inching toward rate cuts.

Investors now face a familiar question: Is this a one-off spike, or the start of a broader commodity resurgence?

Crude is one of the most economically sensitive assets in the world. When oil jumps that quickly, the concern isn’t just energy stocks or gasoline prices. It’s inflation. And if inflation expectations tick higher, especially after months of easing, rate cut timing could be pushed back.

That’s exactly the fear. The Fed has made it clear that stable prices remain the priority. A $10-per-barrel oil jump in one week may not shift their course, but if it sticks or worsens markets could start re-pricing the entire summer rate cut narrative.

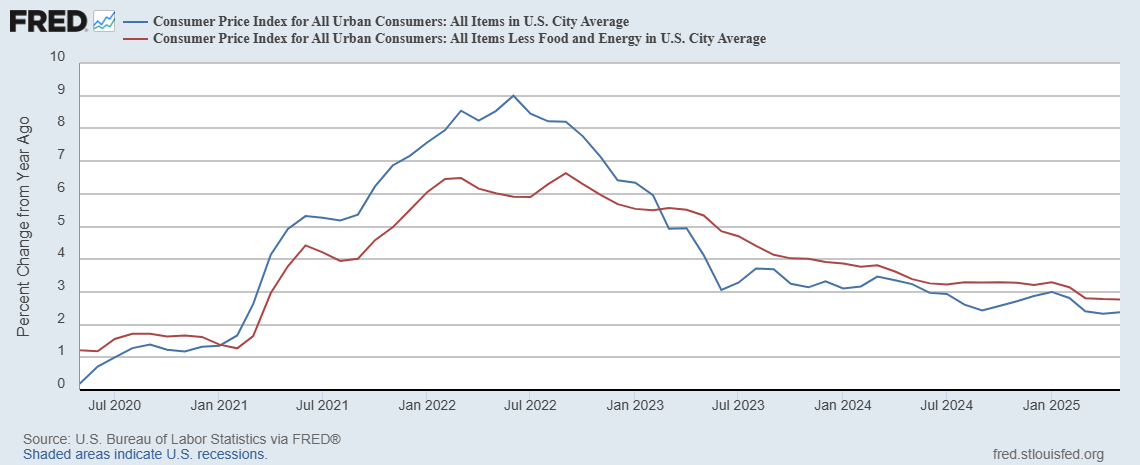

With core inflation still lingering above the Fed’s comfort zone and tariff-related cost increases on deck, oil’s behavior from here will play a key role in shaping macro expectations.

CPI rose just 0.1% in May, with annual inflation steady at 2.4%—a sign that tariffs have not yet pushed prices higher.

The latest inflation data brought some relief. The Consumer Price Index rose just 0.1% in May, a softer print than most economists had expected. That slowdown helped ease worries that elevated tariffs would reignite inflation pressures.

On a year-over-year basis, inflation came in at 2.4%, exactly in line with forecasts. That figure also held near the four-year low recorded back in April, offering further confirmation that pricing pressures remain contained—for now.

In an environment where the Federal Reserve is weighing rate cuts, inflation reports like this carry more weight than usual. A low print gives the Fed more flexibility to ease policy without risking a credibility hit on its price stability mandate. With tariffs still active and oil prices volatile, the market had reasons to expect a stronger reading. This result puts those fears on pause.

It also reinforces the idea that disinflation is not just a headline trend but a consistent one. Consumer-facing companies are struggling to raise prices, and many continue to highlight value strategies rather than pricing power in their earnings calls.

Whether this inflation cooldown holds in the face of renewed geopolitical risks and trade friction remains to be seen. But for now, the Fed is getting exactly what it wants: soft data that leaves the door open to policy action.

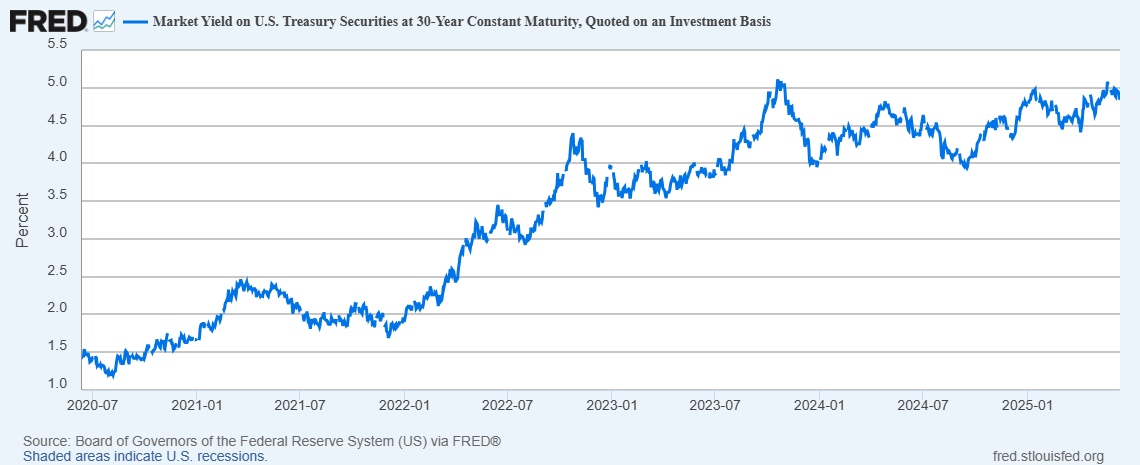

30-year Treasury auction draws solid demand, cutting yield to 4.84% and easing fears after last week’s brief spike above 5.00%.

Thursday’s 30-year Treasury auction offered a dose of calm to a market that’s been jittery over rising long-term yields. The auction generated stronger-than-expected demand, helping ease recent concerns about the government’s ability to attract buyers for its debt.

The bonds were sold at a yield of 4.84%, comfortably below the 4.91% closing yield from the prior day. That gap signaled a healthy appetite from institutional buyers, even as the total supply of government debt continues to grow.

Just last week, the yield on the 30-year briefly pushed above 5.00%, a level not seen since 2007. That spike triggered renewed anxiety over the long end of the curve, especially given persistent concerns about deficits, Treasury issuance, and inflation risk.

Thursday’s result doesn’t resolve those long-term concerns, but it suggests demand for safe, long-dated assets remains intact. Lower yields also ease borrowing costs for the government, corporate issuers, and even mortgage markets, which often track the long end of the curve.

With inflation data softening and the Fed nearing a potential pivot, the auction outcome may reflect renewed confidence in a stable rate path ahead. It also shows that not all buyers are waiting for yields to push higher.

Gold resumed its upward march this week, breaking through previous records and closing in on levels few expected this soon. By Friday afternoon, the precious metal was trading around $3,450 per ounce, up from $3,320 just a week earlier and well above the $2,600 mark at the end of last year.

That’s a year-to-date gain of more than 30%, with the bulk of the move accelerating in recent weeks. Previous highs set in late April and early May now look modest by comparison.

What’s driving the rally? A mix of renewed geopolitical risk, lingering inflation concerns, and a cautious Federal Reserve. In an environment where rate cuts seem increasingly likely but uncertainty still dominates headlines, gold is finding broad support from both institutional and retail investors.

Gold has long served as a safe haven during moments of macro stress. But what’s different this time is the strength of the move despite a relatively calm dollar and no major crisis moment. Instead, the rally seems tied to structural concerns, rising debt loads, doubts about central bank control over inflation, and global shifts in reserve strategies.

With real yields pulling back slightly and demand from central banks still strong, gold is behaving more like a long-term strategic asset than a short-term hedge.

After months of uncertainty, U.S. and Chinese officials made tangible progress in a two-day negotiating session focused on tariffs and broader trade tensions. The two sides reached a framework agreement on several core issues, a potential step toward easing one of the most persistent sources of global economic friction.

Officials confirmed that a consensus was reached on key disputes, although final approval is still required from both presidents before the terms can be implemented. Markets viewed the update cautiously. While the language signaled real movement, investors are waiting to see whether a deal is finalized—or if it stalls again at the top level.

The tariff overhang has weighed on corporate planning and inflation expectations for months. An agreement could unlock investment flows, ease supply chain stress, and shift central bank calculus by reducing one of the key inflationary headwinds.

That said, nothing is done until it’s signed. Traders have seen this movie before—apparent progress followed by political walk-backs. Still, even the prospect of movement helped steady global sentiment heading into the weekend.

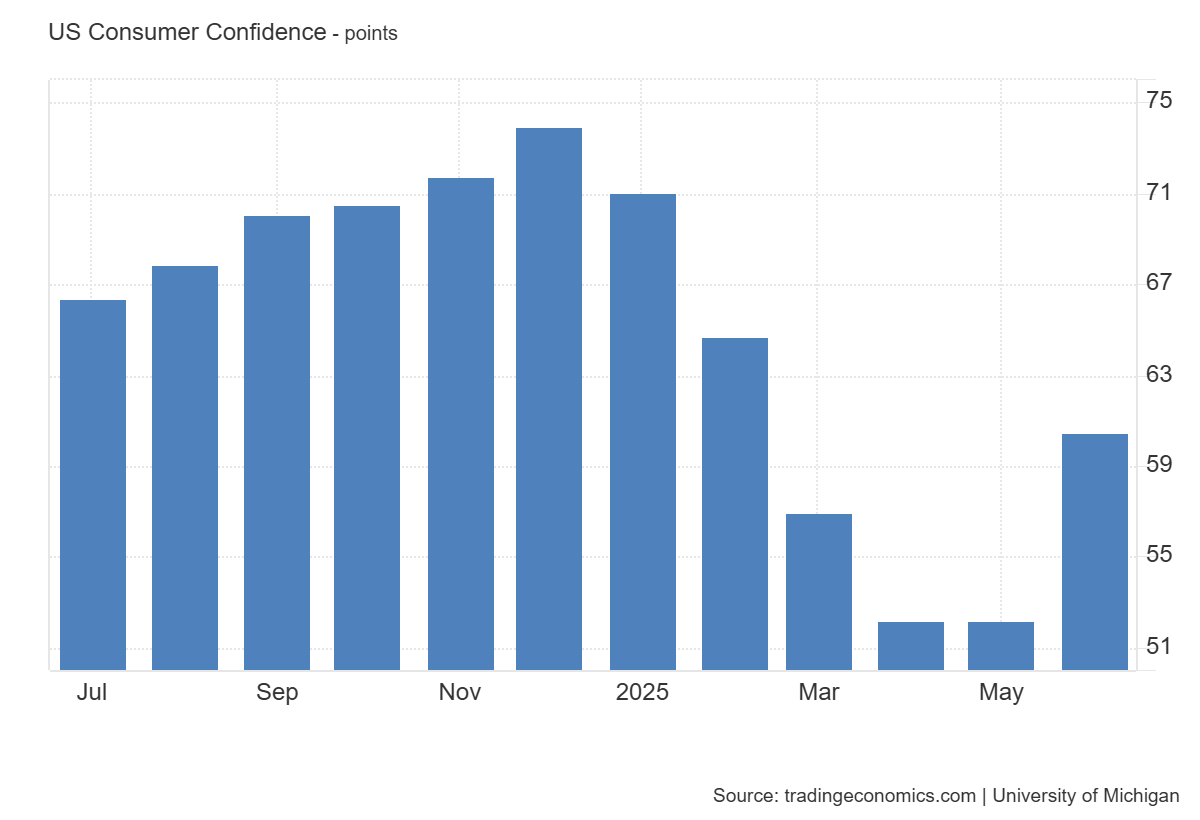

For the first time in half a year, U.S. consumer sentiment moved higher. The University of Michigan’s preliminary reading for June came in at 60.5, up sharply from 52.2 at the end of May. That 8.3-point surge was well above expectations and marked the first meaningful improvement since late 2023.

What changed? The survey suggests that inflation fears have begun to ease, at least at the household level. Participants reported slightly better views on both current conditions and future expectations, signaling a more stable outlook for consumer behavior as summer begins.

This kind of bounce in sentiment doesn’t guarantee stronger spending, but it does support the broader soft-landing narrative. When people feel less anxious about prices, they’re more likely to maintain or even increase their spending levels—an important input for GDP growth.

Economists were surprised by the size of the jump, especially with ongoing uncertainty around tariffs, oil prices, and labor market softness. Still, the trend matters more than the surprise. After six months of declines, the shift offers a bit of macro breathing room.

The Federal Reserve is widely expected to hold interest rates steady this week as it wraps up its two-day policy meeting on Wednesday. That part is no surprise. But what happens after that remains a matter of debate—and markets are still leaning toward a more dovish outcome by year end.

According to CME Group’s FedWatch tool, pricing in the interest rate futures market suggests that most investors now anticipate one to three quarter-point rate cuts before the end of the year. This expectation held firm even after a week of mixed macro data and a volatile spike in oil prices.

The Fed has stayed cautious, insisting that it needs to see further signs of inflation easing before pulling the trigger on cuts. However, softening consumer data, a cooling labor market, and now rising geopolitical risks are adding pressure to act sooner rather than later.

For now, the message from the central bank may sound familiar:

Higher for longer, data dependent, and not ready to declare mission accomplished.

But futures markets continue to price in a pivot and the longer that divergence holds, the more sensitive markets will be to changes in tone or language from the Fed.

🐂 Bull’s View:

Geopolitical shocks may rattle nerves, but they haven't derailed fundamentals. Oil’s surge is inflationary, yes, but CPI data shows pricing pressure is still tame. Treasury demand is healthy, rate cuts remain on the table, and consumer sentiment is finally rebounding. The Fed has room to act if needed. Risk may be high but the macro path is still intact.

🐻 Bear’s View:

The Israel–Iran escalation is more than headline risk, it’s a direct hit to global energy infrastructure. Oil spiking 12% in a week is a red flag for inflation and central bank policy. Add in renewed supply chain stress, rate cut uncertainty, and weekend geopolitical volatility, and markets look fragile. This is not priced in and it could trigger a broader repricing.

The Week Ahead: June 17–21, 2025

Monday:

No major reports. A quiet start.

Tuesday:

- 🛍️ Retail Sales: We’ll learn how much people are spending at stores across the U.S.

- 🏭 Factory Output: The Fed reports on how busy U.S. factories have been.

Wednesday:

- 📦 Business Inventory Data: Tells us how much stuff companies are keeping on hand.

- 🏡 Homebuilder Confidence: Are builders feeling optimistic about the housing market?

- 🏛️ Big Fed Decision Day: The Federal Reserve wraps up a major policy meeting and Fed Chair Jerome Powell will speak. This could move markets depending on what they signal about interest rates.

Thursday:

- 🏠 New Home Construction: We’ll get data on how many homes were started in May.

- 💼 Jobless Claims: A weekly checkup on how many people applied for unemployment benefits.

- 🇺🇸 Juneteenth Holiday: U.S. markets will be closed.

Friday:

- 🔮 Leading Economic Index: Several data points to help predict where the economy might be heading.

Extras

🚀 Nvidia Unleashes AI Cloud in Europe

Nvidia is going global with a major AI cloud project in Europe, doubling down on growth even as U.S. chip restrictions cut off China.

🤝 Meta Buys Into Scale AI — Google Pulls the Plug

Meta spent $14.8B for a 49% stake in Scale AI to supercharge its AI training data. Google promptly backed out, fearing data spillovers.

📈 Oracle Skyrockets on Cloud Boom

Oracle shares surged 24% to a record high after blowout earnings and surging demand for its cloud services.

⚡ AMD Takes the Fight to Nvidia

AMD launched new AI chips, raking in $5B in 2024 and forecasting 60% more in 2025 — gunning directly for Nvidia’s turf.

🌩️ Google Cloud Hit by Global Outage

A widespread outage across Google Cloud services disrupted users worldwide, raising red flags for critical infrastructure.

📱 Apple Dominates China’s Smartphone Market

iPhone sales jumped 15% globally, with Apple now leading in China — a major win despite growing trade headwinds.

📊 IPO Party Is Back — Chime Rings the Bell

Chime raised $700M in a successful Nasdaq debut, signaling strong investor appetite for fintech and tech IPOs.

🧠 AI Toys? Mattel Partners with OpenAI

Mattel is bringing toys to life using OpenAI’s tech, betting on smarter playtime as it diversifies beyond dolls and games.

🧊 Nvidia Freezes China Out of Forecasts

New U.S. export rules pushed Nvidia to exclude China from revenue projections — a big pivot with geopolitical overtones.

🏗️ Crusoe Builds $400M Data Center — With AMD Chips

Crusoe Energy is challenging Nvidia in the AI cloud war, launching a new data center powered entirely by AMD hardware.

🏥 Amazon Reshapes Healthcare Business

Amid exec departures, Amazon reorganized its healthcare ops into six focused units to sharpen its growth strategy.

💉 Moderna Tanks on CDC Vaccine Doubts

Shares of Moderna and other vaccine makers fell after the CDC held back support for its RSV vaccine rollout.

🧬 BioNTech Buys CureVac for $1.25B

In a big bet on cancer vaccines, BioNTech acquired CureVac to bolster its mRNA drug pipeline.

🧪 23andMe’s Assets Snapped Up by Wojcicki Nonprofit

Anne Wojcicki’s nonprofit won 23andMe’s core assets for $305M, beating out Regeneron for control of the DNA database.

🧵 Gap Gains on Old Navy, But Tariffs Loom

Gap posted a 5% sales boost driven by Old Navy, though rising tariff costs and store closures threaten momentum.

☕ Luckin Coffee Sets Sights on U.S. Market

China’s Luckin Coffee is taking on Starbucks with plans for U.S. expansion and unique local offerings.

🏡 RH Pops 15% on Strong Earnings and U.S. Expansion

RH beat earnings expectations and revealed plans to ramp up domestic production, sending shares soaring.

📺 McDonald’s Settles $10B Suit with Byron Allen

The fast-food giant agreed to invest in Black-owned media as part of a high-profile lawsuit resolution.

🚗 Tesla Raises U.S. Prices on Model S and X

Tesla hiked prices following vehicle upgrades, maintaining margins amid shifting EV market dynamics.

🇨🇳 Virtu Targets China’s Booming ETF Market

Virtu Financial is pushing into China’s ETF space, aiming for growth despite intensifying U.S.-China tensions.

📡 EchoStar Soars 52% on FCC Settlement Hopes

EchoStar shares spiked after reports of potential resolution talks with the FCC over key spectrum licenses.

₿ Trump Media Pulls Off $2.3B Bitcoin Deal

In a bold move, Trump Media raised $2.3B using bitcoin, drawing fresh attention to crypto-backed financing.

📉 FTC Eyes $13.25B Ad Giant Merger

Omnicom’s planned merger with Interpublic is under FTC review, with concerns about control over digital ad markets.

✈️ Boeing Resumes Jet Deliveries to China

Deliveries of Boeing jets to China are back on — a critical step in rebuilding cross-border aerospace ties.

🌍 Ford Faces Rare Earth Shortage Outside China

Ford is racing to secure non-China sources of rare earths amid looming shortages and EV production risks.

🛩️ Archer Raises $850M for Flying Taxis

Archer Aviation secured $850M to build out its electric air taxi vision — blending infrastructure with AI tech.

🔋 Amazon and RWE Team Up on Renewable Energy

Amazon signed a major clean energy deal with RWE to power AI operations and boost energy innovation.

🌋 Meta Bets on Geothermal Power

Meta is backing geothermal firm XGS Energy to fuel its massive AI workloads with next-gen clean energy.

🌾 Crop Giant Created in $34B Bunge-Viterra Merger

Regulators cleared the way for Bunge to merge with Viterra, forming a global crop trading powerhouse.

💥 Air India Crash Kills 242

A Boeing 787-8 crash in Ahmedabad claimed all 242 lives onboard — triggering global aviation investigations.

🌍 Markets Dip on Middle East Escalation

Geopolitical tensions between Iran and Israel rattled markets, lifted oil, and sent U.S. stock futures lower.

🚤 Taiwan Builds Sea Drone Fleet to Counter China

Taiwan is developing autonomous sea drones as part of its growing defense strategy against Beijing’s pressure.

🏨 U.S. Hotels Struggle to Fill Jobs

Hotels across America are battling a labor crunch, made worse by restrictive immigration policies and high turnover.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments