I’m Gokcan, and this is — where I track what’s happening in the markets, not with flashy headlines, but with honest thoughts and clear takeaways. I write to make sense of big moves, subtle shifts, and long-term signals. Sometimes I’ll share what I’m buying and why — not as advice, just to stay thoughtful and disciplined about my own decisions.

Stock Unlock helps you cut through the noise with powerful stock screeners, intuitive financial visuals, and real-time portfolio insights—all in one clean, easy-to-use platform. Whether you're just starting out or managing a serious portfolio, it’s a smarter way to analyze companies and make confident decisions.

Oil jumped 4%, and yields fell as Middle East tension rises. Retail sales were mixed. Markets leaned risk-off, not panicked.

- The market’s not panicking, but it’s clearly getting cautious

- Oil is becoming the main inflation wildcard again

- The Fed’s job just got more complicated if this continues

- Risk assets aren’t collapsing, but the tone has definitely shifted

The big theme was the rising tension between Israel and Iran, and now it’s looking like the U.S. might get more directly involved. No official moves yet, but markets are starting to price in that possibility. You could feel the risk-off tone across everything.

Oil prices jumped another 4% today, which makes sense given what’s happening in the Middle East. Traders are worried that supply could be disrupted if things spread, especially with strikes already hitting Iranian gas and oil infrastructure. And when oil spikes, it tends to ripple through the rest of the market — which is exactly what happened.

Stocks were down across the board. Not a crash or panic, but a noticeable pullback. It wasn’t driven by economic data or earnings — just geopolitical nerves. The kind of day where no one wants to take on too much risk.

At the same time, bond yields dropped, which tells you investors were moving into safer assets. People were buying Treasuries, which drives yields lower. And the U.S. dollar strengthened, another classic safety play. So it was pretty textbook risk-off positioning.

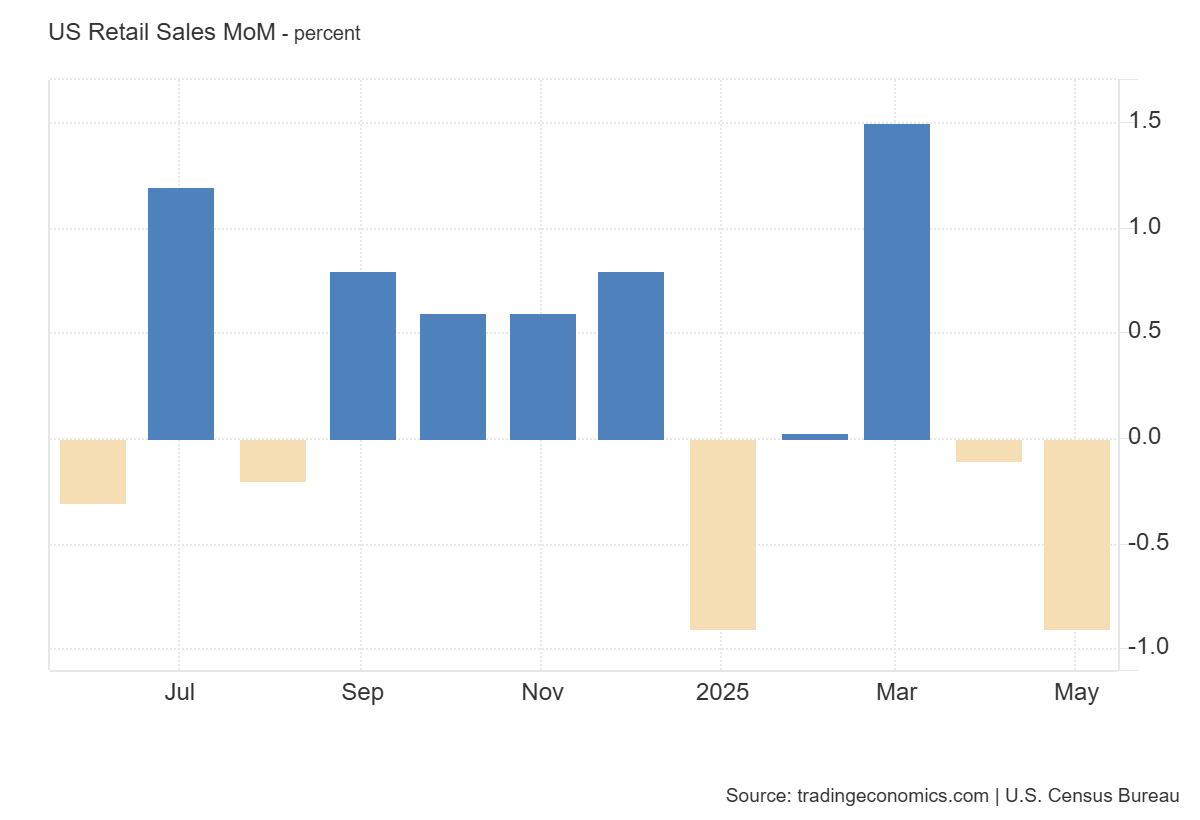

We also got some economic data, and it was kind of a mixed bag. Headline retail sales for May came in soft, which initially looked a little concerning. But the control group — the part of retail sales that feeds into GDP — was up 0.4%, which matched expectations. So under the hood, consumer spending is still holding up decently.

Overseas, the Bank of Japan kept rates unchanged at 0.5%, which is what markets expected. Asian stocks were mixed — no big moves there — but European markets closed lower, probably reacting to the same geopolitical tensions.

Retail sales fell 0.9% in May, but core spending rose 0.4%. Discretionary categories held up, showing consumers aren’t backing off yet.

We got the May retail sales numbers today, and they weren’t great on the surface. Headline sales dropped 0.9%, which was worse than expected, the market had been looking for a 0.7% decline. The big drag came from building materials and motor vehicles, which makes sense. Car sales had a huge pop in March, probably because people rushed to buy ahead of expected tariffs, so this could just be some of that demand pulling back.

To make things a little worse, April’s retail sales were revised lower, from a tiny +0.1% to a small decline of -0.1%. So the two-month trend isn’t doing any favors.

But if you dig a little deeper, the control group, the part that strips out volatile stuff like gas, autos, and building materials was solid. It rose 0.4%, which matched expectations. That’s actually the number economists care about most because it gives a cleaner read on underlying spending.

What stood out to me was discretionary spending held up pretty well. Categories like furniture and clothing saw decent gains, which suggests that households still feel comfortable spending on non-essentials. That’s not what you’d expect if consumers were pulling back out of fear.

So here’s how I’m thinking about it:

- The top-line number was soft, but the internals weren’t weak enough to panic

- Consumers are still spending — just shifting around categories

- Household finances and the job market are still supportive, so unless something breaks, the spending trend should hold up through the rest of the year

📌 What I’m watching

- Whether this consumer resilience holds if energy prices stay elevated

- If revisions keep trending lower, it could mean the slowdown is just taking longer to show up

- Upcoming earnings from big retail names will help confirm the vibe

Fed Watch: Decision Coming, Eyes on the Dots

Markets will be laser-focused on the updated economic forecasts, especially the dot plot, which shows where FOMC members think rates are headed. Back in March, the median view still pointed to two rate cuts in 2025. A lot’s changed since then, inflation has cooled a bit, and the labor market looks like it’s finally softening.

So the big question is:

Personally, I think the Fed holds the line this meeting, no pivot, no drama but keeps the door open for easing later this year. That would align with the idea that they’re watching the data, not rushing into anything, but still acknowledging that tighter policy is doing its job.

If inflation keeps trending lower and the job market doesn’t bounce back too hard, I’d still expect one or maybe two cuts in the back half of 2025. That would bring some relief on borrowing costs and give the economy a bit of a cushion heading into next year.

Deficits mount. Gold replaces trust. Labor squeezes tighten. Market risks aren’t loud but they’re building where we don’t look.

I listened to a deep (and slightly chaotic) conversation today with a familiar voice in the risk world, someone who helped popularize the idea of "black swans." (Nassim Nicholas Taleb) What stood out wasn’t the drama of tail risks, but how calmly he walked through what feels like a slowly compounding set of structural problems.

The first big theme was the U.S. fiscal situation. Nothing new on paper, deficits are huge, interest payments are rising, and it’s all snowballing but the reminder was sharp: we’re at a stage of development where growth naturally slows (fewer people in poverty, less catch-up GDP). And instead of borrowing less in this slower-growth phase, we’re still ramping up spending. It’s not a partisan view, more of a systems-level one. He compared it to being at the top of an S-curve: when growth potential flattens, borrowing aggressively makes less sense.

Then came the market structure angle: he said markets aren’t really pricing in “real world” outcomes. They move based on allocation rules, things like portfolio mandates, rebalancing mechanics, and quarterly optics, not fundamental economic forecasts. It’s not that markets ignore long-term risks, it’s just that they don’t price them in until they hit.

On systemic risk, he surprised me a bit. He thinks we’re less at risk now than in 2008, not because things are healthier, but because risk has migrated away from banks to hedge funds and private money. He sees that as a net positive. Hedge funds don’t get bailouts, and they’ve got their own money at stake. Less moral hazard. Less opacity risk unless taxpayers get dragged in.

But where it got really interesting was on gold and the dollar’s status. He argued that gold is quietly becoming the real reserve asset, not officially, but through behavior. Countries are still transacting in dollars, but they’re stockpiling gold in the background. Why? Trust erosion. After U.S. sanctions froze Russian accounts, other countries started pulling back from dollar exposure, not because they like gold better, but because gold can’t be politically frozen.

He pointed to the rise in central bank gold purchases over the past 12 months. And he brushed off forecasts like Citi’s “gold may peak soon” take.

His response: “How would they know?” In his view, the move into gold isn’t tactical, it’s structural.

Last piece that stuck with me: he doesn’t think AI or tariffs will fix this. He sees the current policy environment as irrational. The new tariffs, especially on things the U.S. doesn’t even produce, end up taxing the poorest while pretending to be strategic. And immigration restrictions? He called that a hidden inflation trigger. The U.S. economy runs on cheap labor, and without it, prices on everything from lawn care to construction to services, will rise.

📌 What I’m thinking after this

- The U.S. deficit issue isn’t going away — it’s likely to accelerate

- Gold is quietly replacing trust in the dollar for storage, not transaction

- Hedge funds may be less scary than banks, but shadow risks still exist

- Structural inflation from labor shortages could be stickier than models expect

Bulls’ Case

- Consumer Still Spending: Despite weak headline retail sales, the core control group rose 0.4% — showing consumers aren’t pulling back yet.

- Oil Spike ≠ Panic: Markets are risk-off, not in meltdown. No crash, just caution. That’s resilience, not fragility.

- Fed Still Has Ammo: If unemployment jumps, the Fed can (and likely will) cut rates. Long-term rate trend remains downward.

- Gold Signal: Central banks are buying gold for stability — not panic. This move suggests preparation, not disaster.

Bears’ Case

- Geopolitical Risk Rising: Middle East tension escalates. If U.S. gets involved, energy markets and inflation expectations could spiral.

- Retail Sales Trend Weakening: April was revised down. Discretionary strength may not last if fuel prices stay high.

- Fed in a Bind: Oil-driven inflation could delay rate cuts just as layoffs rise — risking a “too late” Fed pivot.

- Market Structure Fragile: Allocations are rule-driven, not fundamentals-based. Any shock could trigger a sharp repricing.

⚖️ The setup: Consumer resilience is keeping the market afloat — but oil, tariffs, and delayed Fed cuts are pressure points. Risk isn't exploding, but it’s quietly stacking.

Extras

📹 Facebook Goes All-In on Reels

Facebook is rebranding all video content as Reels, rolling out new creative tools and pushing the update globally to boost engagement.

📊 Canva Buys MagicBrief, Eyes Ad Intelligence

Canva acquired MagicBrief to break into ad analytics and competitor tracking. No IPO planned for 2025 — they're staying private and strategic.

🕶️ Meta & Ray-Ban Bet Big on Smart Glasses

Meta and EssilorLuxottica aim to sell 10M AI-powered Ray-Ban Meta smart glasses by 2026, blending fashion with functionality.

🤖 Amazon Slashes Corporate Jobs Amid AI Surge

Amazon plans more corporate job cuts as internal AI tools scale, highlighting a broader shift toward workforce automation.

🚕 Waymo Hits 250K Weekly Robotaxi Rides

Waymo expanded its driverless ride services in California, now offering over 250,000 robotaxi rides per week.

📈 Reddit Rises on AI Ad Rollout

Reddit shares jumped 5% after launching AI-powered ad tools, driving advertiser interest and new revenue streams.

🌍 Tencent Expands Cloud to Europe

Tencent is scaling its European cloud services, targeting gamers and streamers with AI-enhanced offerings.

🧠 Oracle Teams with xAI for AI-First Cloud

Oracle is partnering with Elon Musk’s xAI to integrate new AI models into its cloud, upping its game against Big Tech rivals.

🌐 Google Apologizes for Major Outage

After a widespread services outage, Google issued a rare public apology and pledged to bolster its infrastructure.

Nvidia Pushes for ‘Sovereign AI’ in Europe

Nvidia is championing regional AI independence in Europe, partnering with local firms to build alternatives to U.S.-dominated infrastructure.

Meta Names New India Chief

Meta appointed Arun Srinivas as managing director for India, strengthening its leadership in a fast-growing market.

🧠 Sword Health Expands into AI Mental Care

Sword Health is entering the mental health space with AI-powered care solutions, fueled by a new $40M funding round.

💊 Eli Lilly Eyes $1.3B Verve Deal

Eli Lilly is in talks to acquire Verve Therapeutics, a gene-editing biotech, in a deal that could reach $1.3 billion.

⚠️ Sarepta Plunges 30% on Gene Therapy Death

A fatality linked to a gene therapy trial sent Sarepta shares tumbling, raising safety and regulatory concerns.

🛍️ Amazon Expands Prime Day to 4 Days

Amazon is extending Prime Day to a four-day event, aiming to lure Gen Z shoppers in a crowded e-commerce battlefield.

🍿 Netflix to Open ‘Netflix House’ Experience Venues

Netflix is going physical, launching Netflix House venues to offer immersive experiences and boost user loyalty.

🌈 Kraft Heinz Ditches Artificial Dyes by 2027

Kraft Heinz will eliminate all artificial food dyes by 2027, aligning with health trends and FDA scrutiny.

👟 ASICS Ramps Up India Production

ASICS is increasing local manufacturing in India to sidestep import hurdles and unlock major revenue growth.

🔗 JPMorgan Launches Blockchain-Based Token

JPMorgan unveiled JPMD, a blockchain deposit token launched on Coinbase’s Base to modernize asset settlement.

📉 Coinbase Eyes SEC Nod for Tokenized Stocks

Coinbase is seeking approval to offer tokenized equities, setting up a direct challenge to Wall Street's status quo.

💳 JPMorgan, Amex Boost Perks — and Fees?

Premium credit card perks are getting a facelift at JPMorgan and Amex, with rumors swirling of a Sapphire fee hike.

🏦 Commerce Bancshares Buys FineMark for $585M

Commerce Bancshares will acquire FineMark Holdings in a $585M stock deal to expand its regional banking footprint.

🛑 Tesla Dips on Production Halts, Expands Robotaxis

Tesla shares fell 2% on production pause reports, even as it launched a new robotaxi service in Austin.

🛫 Airbus Lands $9.4B Jet Deal with VietJet

Airbus secured a $9.4B order for 150 jets from VietJet, reinforcing its position in Asia’s booming aviation market.

🏗️ U.S. Steel Gains on $14.9B Nippon Deal

U.S. Steel rose 5% as Nippon Steel’s buyout plan confirmed a “golden share” to preserve U.S. control.

🚘 JLR Cuts Forecast on U.S. Tariff Woes

Jaguar Land Rover slashed its 2026 margin outlook due to U.S. tariffs, dragging down parent Tata Motors’ stock.

⚡ Senate Bill Threatens Solar, Wind Tax Credits

A new Senate proposal would end solar and wind tax credits by 2028, rattling clean energy stocks while preserving other energy incentives.

🚢 Hormuz Tensions Spike Freight Costs

Ships are avoiding the Strait of Hormuz amid Israel–Iran tensions, causing a sharp surge in freight rates.

🧠 Reddit Doubles Down on AI Ad Targeting

Reddit is enhancing ad tools with AI to better target users and boost brand engagement in a competitive ad market.

🚗 Renault CEO Resigns, Shares Slip

Renault CEO Luca de Meo stepped down, triggering investor uncertainty and leadership transition speculation.

⚖️ SCOTUS to Hear Exxon, Chevron Case

The U.S. Supreme Court will take up a key case involving ExxonMobil and Chevron over Louisiana climate lawsuits.

📱 Trump Phone's 'Made in USA' Claim Questioned

Trump Org’s new smartphone faces scrutiny for labeling it U.S.-built, amid signs of Chinese parts and assembly.

💎 Fugitive Jeweler Choksi Faces Extradition

Mehul Choksi’s extradition battle inches forward as he faces mounting fraud charges in India and abroad.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments