I’m Gokcan, and this is

Portfolio Activity

— a daily investing journal built for clarity, not noise.

Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

Portfolio Activity

— a daily investing journal built for clarity, not noise.

Each post breaks down key market moves, macro shifts, and long-term signals — with grounded insights, not hype. I may also share what I’m buying and why. Not advice — just part of building sharper habits and clearer thinking.

New here?

Get daily updates delivered straight to your inbox — free.

No spam. Unsubscribe anytime.

Stock Unlock helps you cut through the noise with powerful stock screeners, intuitive financial visuals, and real-time portfolio insights—all in one clean, easy-to-use platform. Whether you're just starting out or managing a serious portfolio, it’s a smarter way to analyze companies and make confident decisions.

Today's Stories

Stocks dipped as Trump delayed a decision on Israel–Iran. Oil rose on supply fears, and markets leaned defensive heading into the weekend.

Markets ended Friday on a cautious note. The big headline? President Trump decided to hold off for two more weeks on making a call about U.S. involvement in the Israel–Iran conflict. That gave investors some breathing room but also left a lot of uncertainty hanging in the air.

Energy stocks rose as oil prices climbed. With both Israel and Iran trading air strikes, traders are watching closely for any sign that global supply could get disrupted. Consumer staples also did well, a sign that investors are looking for safety in more reliable, less volatile corners of the market.

On the flip side, communication and materials stocks struggled, dragging the broader indexes lower. It wasn’t a panic just a slow drift as investors took a step back.

Globally, the picture was mixed. Asia didn’t move much, though China’s central bank holding its loan rate steady didn’t surprise anyone. Over in Europe, stocks were up even though consumer confidence data dipped, suggesting investors are still leaning optimistic, at least for now.

The U.S. dollar slipped a bit against other major currencies, while oil jumped again, pushing WTI prices higher. It’s clear the market’s mood is fragile, watching headlines, waiting for clarity, and hoping for cooler heads to prevail in the Middle East.

The Fed says two rate cuts are still the plan, but tariffs and inflation could mess with that. More clues coming next week.

So, the Federal Reserve just shared where they stand on interest rates. Right now, they’re still saying they expect to lower rates twice by the end of the year. That’s the same plan they had a few months ago.

But when Powell spoke about it, you could tell things aren’t quite as certain anymore.

He said the economy's holding up alright, not booming, but not falling apart either. What could throw things off? Tariffs. He’s worried they could make stuff more expensive and slow things down. Basically, he’s saying: “We’ll wait and see what happens before making any moves.”

People watching the market don’t think the Fed will touch rates in July. Maybe in September, but it depends on how inflation looks by then. If it’s still high, they might not cut at all. Some analysts already think we’ll only get one cut this year or maybe none.

One Fed governor, Waller, sounded a bit more open to moving sooner. He said a July cut could still happen, but he didn’t sound overly confident about it either.

Powell’s going to talk to Congress next week, so we might get a better sense of their thinking then. For now, though, nothing’s changing but they’re definitely being cautious.

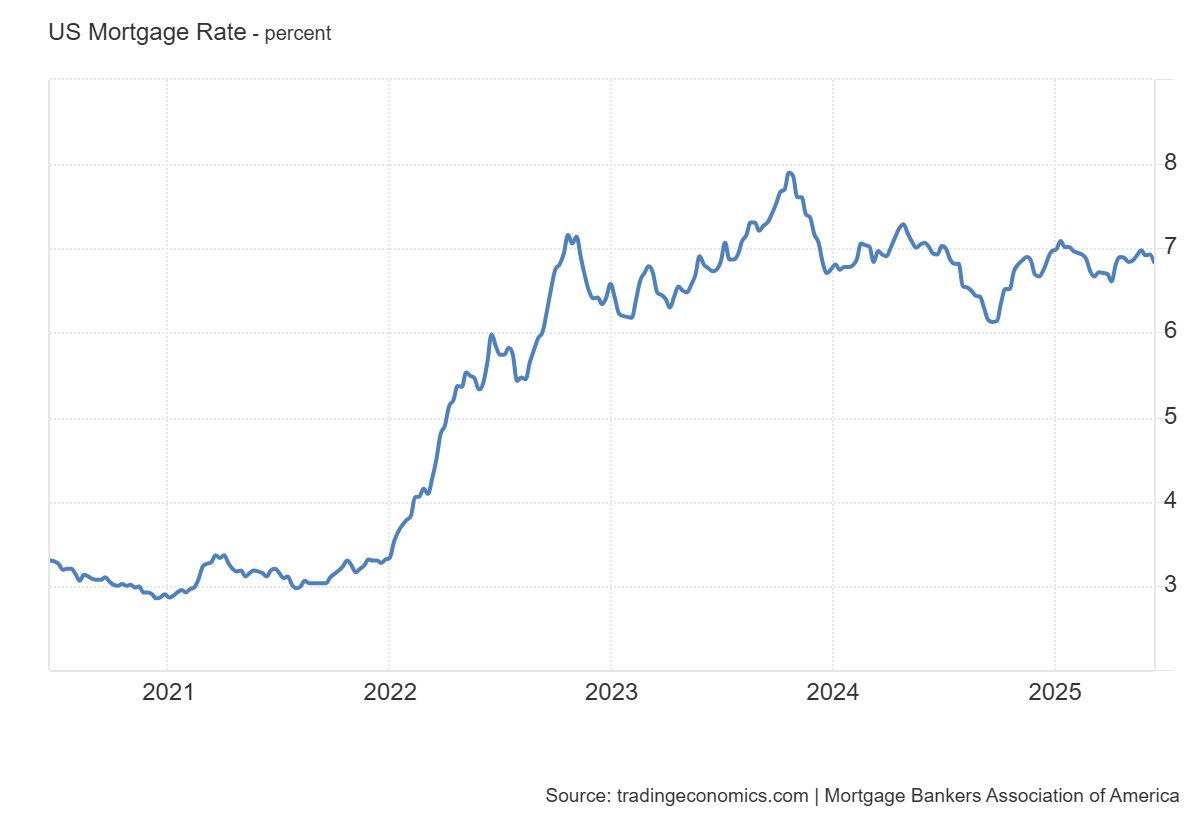

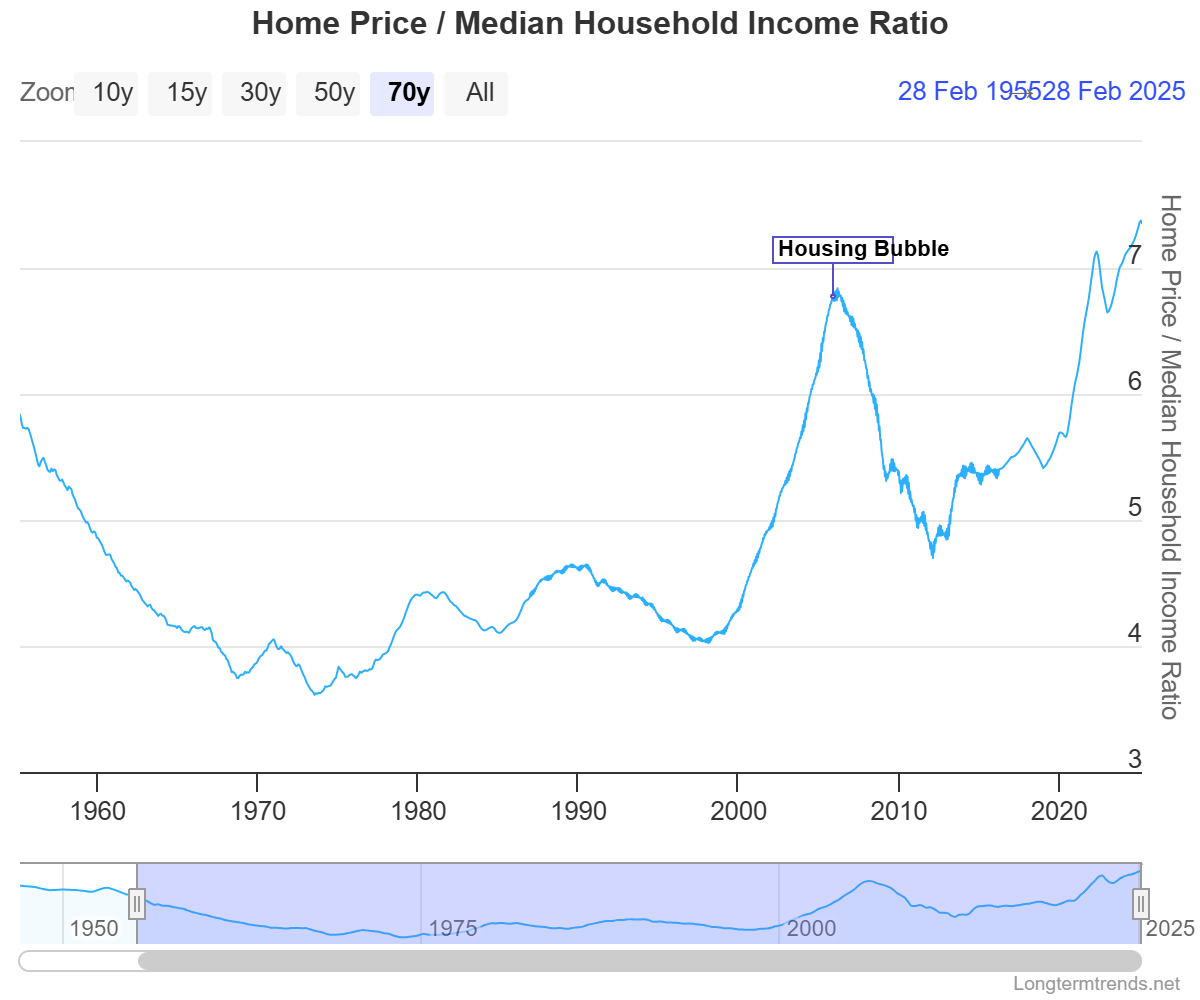

High mortgage rates are still freezing the housing market. Builders feel it, buyers feel it.

This week wasn’t just about the Fed meeting, we also got a bunch of housing data and earnings from big homebuilders. And the story they’re telling? The market’s cooling again.

Lennar beat Wall Street’s sales forecast, but even they admitted demand feels softer. Next up is KB Home, which reports Monday, we’ll see if they say the same. On top of that, housing starts in May dropped to their lowest point this cycle, and building permits are sliding too. It’s clear that high mortgage rates are still putting pressure on the whole housing pipeline.

Put simply, higher borrowing costs are still dragging on the market. And the Fed? They’re not budging yet. They held rates steady again, making this the fourth meeting in a row with no change.

That means mortgage rates are still high, the 30-year fixed was around 6.81% last week. Yes, it’s down a bit from earlier this year, but it’s nowhere near what buyers were used to just a couple of years ago.

And here's the thing to watch next: existing home sales. People have been reluctant to sell, mostly because they don’t want to give up their low-rate loans. But life happens and eventually, folks do move. Whether or not we start seeing more of that could shape the rest of the year for the housing market.

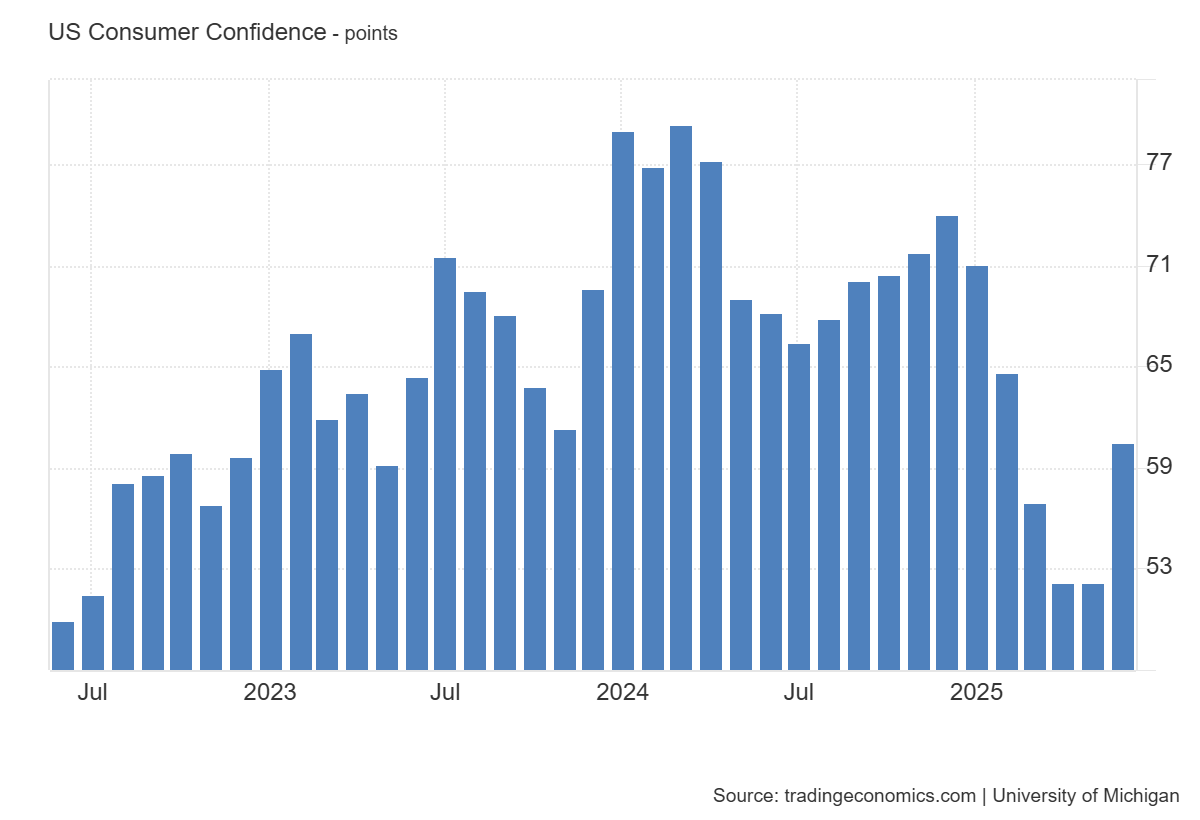

Consumer confidence still holds the key to growth but tariffs and a fragile job market could test sentiment in the weeks ahead.

Consumer confidence matters a lot. And next week, we get two big updates that could say a lot about where things go from here.

So far, sentiment has improved a bit, but it’s been choppy. Nothing that screams, “The consumer’s back!” just yet. But we’ll see more soon, Tuesday brings the latest read from the Conference Board, and on Friday, we’ll get the final June data from the University of Michigan.

Here’s why that matters: about two-thirds of the U.S. economy is driven by what consumers spend. So if confidence stays weak or takes another hit, it could ripple out into slower growth.

What keeps confidence afloat right now? The job market. As long as people feel secure in their jobs, they’re more likely to keep spending, even if things feel uncertain elsewhere.

That said, tariffs are starting to complicate the picture. If prices rise and companies can’t pass those costs onto customers without losing sales, we could see profits get squeezed and demand slow down.

It’s a delicate balance: confidence is holding up, but not surging. And any hit to that fragile mix through higher prices, job losses, or weak wage growth could shift the market tone fast.

What the Bulls Say

- Fed Still Signaling Rate Cuts

The Fed expects two rate cuts this year. That anchor gives risk assets room to breathe even with inflation risks on the radar. - Energy & Staples Strength Shows Smart Rotation

Investors aren’t running just repositioning. Flows into energy and consumer staples suggest calm, not panic. - Middle East Tensions Are Contained (So Far)

Trump’s decision to delay U.S. involvement buys time. Markets are reading it as a pause, not an escalation. - Consumer Confidence Holding Up

Despite job market softness and tariffs, sentiment hasn’t cracked. Spending remains resilient for now. - Housing Is Slowing, Not Collapsing

Builders still beat expectations (Lennar). Permits are down, but not crashing. Market's adjusting to higher rates, not breaking.

What the Bears Say

- Oil Spike Risks Renewed Inflation

As Israel–Iran tensions heat up, supply fears pushed oil higher. If this continues, it could delay or cancel Fed cuts altogether. - Trump’s Delay = Market Uncertainty

A two-week extension doesn’t solve anything. It extends the overhang and keeps volatility risk alive. - Job Market Softening Beneath the Surface

Rising continuing claims, frozen hiring, and weak wage growth could crack confidence and consumer spending, faster than expected. - Housing Market Is Locked

High mortgage rates are freezing both buyers and sellers. Housing starts just hit a cycle low, and that matters for growth. - Tariffs Could Erode Margins

Even if inflation looks tame now, rising import costs from tariffs may pressure company earnings just as growth cools.

News Worth Watching

🤖 Tesla Defends Robotaxi Plan Amid Safety Probe

Tesla is responding to NHTSA’s inquiry as it begins testing robotaxis in Austin. A broader rollout is coming, despite mounting safety concerns.

📱 Apple Eyes Foldables and AI Startup Buyout

Apple is reportedly in talks to acquire Perplexity AI and is prepping a foldable iPhone with Samsung Display, signaling a dual push into AI and form factor innovation.

💸 Meta Drops $14.3B on Scale AI, Eyes SSI Talent

Meta made a huge AI bet with a non-voting stake in Scale AI, while also scouting engineers from Safe Superintelligence to expand its AI brainpower.

🌍 Google Proposes Fixes to Avoid EU Fines

Google is reworking its search layout to appease EU regulators as it battles antitrust charges and scrutiny over AI data practices.

💼 Microsoft May Cut Ties with OpenAI

Tensions rise as Microsoft reportedly rethinks its partnership with OpenAI and plans major layoffs to double down on internal AI development.

🚕 Waymo Heads Back to NYC Streets

Waymo is resuming autonomous vehicle testing in New York City, reinforcing its push to dominate self-driving urban mobility.

💊 Obesity Drugs Could Hit $150B Market by 2035

Eli Lilly, Novo Nordisk, and others are racing to capture the growing obesity drug market, forecasted to reach $150B in annual sales.

📈 Mounjaro Demand Surges in India

Eli Lilly’s weight-loss and diabetes drug Mounjaro is seeing rapid adoption in India, expanding the firm’s global health footprint.

🛡️ FDA Approves HIV Prevention Pill, But Funding Lags

Gilead’s lenacapavir got FDA approval for HIV prevention, though budget cuts may hinder its rollout to vulnerable populations.

💥 UnitedHealth Hack Disrupts Doctor Payments

A hack targeting UnitedHealth’s Change Healthcare platform has left doctors like Dr. Mazzola unpaid, threatening small-practice survival.

🏋️♂️ New Drugs Aim to Preserve Muscle During Weight Loss

Eli Lilly and Regeneron are advancing treatments that maintain muscle mass while cutting fat, offering a next-gen weight-loss solution.

💵 Walmart Pays $10M to Settle FTC Fraud Case

Walmart agreed to pay $10M after the FTC found its money transfer service enabled fraud, closing a long-running dispute.

🛒 Kroger Lifts Sales Outlook on E-Commerce Gains

Kroger raised its sales forecast after strong online growth, outperforming rivals like Walmart and Costco in key categories.

🍽️ Darden Delivers Growth, Approves $1B Buyback

Darden Restaurants posted higher same-store sales and announced a $1B share repurchase, rewarding loyal investors.

👗 Nike Delays SKIMS Launch to Reboot Brand

Nike pushed back its NikeSKIMS collab with Kim Kardashian, seeking to reposition the brand in a changing fashion landscape.

🛍️ China’s 618 Festival Sees 15.2% Sales Surge

Electronics and beauty led the charge as China’s 618 shopping event delivered strong consumer momentum and double-digit growth.

🔀 Citi Hires JPMorgan Dealmaker for M&A Push

Citigroup brought in JPMorgan’s Drago Rajkovic as co-head of M&A, aiming to step up its dealmaking game.

🪙 Ether ETFs Pull In $3.9B Despite Crypto Dip

Despite price drops, Ether ETFs are seeing strong inflows, showing long-term investor confidence in Ethereum’s role in finance.

📲 JPMorgan Upgrades App with Bond Tools

JPMorgan launched new features on its app, allowing retail investors to buy bonds and CDs more easily.

🧩 Circle Pops as Senate Passes Stablecoin Bill

Circle’s shares climbed after the Senate approved the GENIUS Act, a big step toward U.S. stablecoin regulation.

🔋 Tesla Plans Huge Battery Plant in China

Tesla is building a grid-scale battery facility in China, challenging local firms while navigating U.S.–China tech tensions.

🤝 Foxconn and Nvidia Team Up on AI Robots

Foxconn is working with Nvidia to create humanoid robots designed for building AI servers, merging automation with AI supply chain needs.

⚖️ Boeing Escapes Prosecution in DOJ Deal

Boeing avoided criminal charges over the 737 Max crashes through a DOJ settlement, sparking anger from victims’ families.

🛫 Embraer Soars on Paris Airshow Orders

Embraer locked in major new aircraft deals at the Paris Airshow, boosting its backlog and lifting shares.

☢️ Apollo Funds UK Nuclear Build with £4.5B

Apollo Global is investing £4.5B in the UK’s Hinkley Point nuclear project, cementing private equity’s growing energy footprint.

🔥 Japan May Boost LNG Imports Amid Decarbon Woes

If green goals lag, Japan could hike LNG demand, locking in long-term supply contracts and reshaping Asia’s energy flows.

🛑 U.S. Reconsiders Tech Waivers for China

The U.S. is weighing the removal of tech waivers for China, a move that could hit semiconductor and AI stocks hard.

🕶️ TDK Buys SoftEye for AI Smart Glasses Play

TDK acquired SoftEye as it ramps up AI hardware efforts, targeting smart glasses and edge computing markets.

🛫 Airlines Cancel Flights After Israel Strikes Iran

Escalating military strikes led major airlines to suspend Tel Aviv flights, heightening travel disruption in the region.

⚖️ Russia Eyes Corporate Return Rules Amid Sanctions

Russia is monitoring foreign firms returning to the country amid war-related sanctions, with U.S. companies in limbo.

🧒 Australia Tests Under-16 Social Media Ban

A trial restricting social media for kids under 16 is showing mixed results, with tech firms facing fines for non-compliance.

📅 The Week Ahead: June 23–27, 2025

Monday (June 23):

- 🏘️ Existing Home Sales (May): A check on how many previously-owned homes were sold last month.

- 🧱 Earnings from KB Home (KBH): A glimpse into how one of the biggest homebuilders is doing.

Tuesday (June 24):

- 🧠 Consumer Confidence (June): Measures how optimistic people feel about the economy.

- 📦 FedEx (FDX) Earnings: Good to watch as a signal of shipping demand and overall economic activity.

Wednesday (June 25):

- 🏡 New Home Sales (May): Tracks how many newly built homes were sold last month.

- 💾 Micron (MU) Earnings: Helps reveal what’s happening in the world of memory chips and tech demand.

Thursday (June 26):

- 🛠️ Durable Goods Orders (May): A look at orders for big-ticket items like machinery and appliances—important for gauging business spending.

- 📊 Q1 GDP (3rd Estimate): The final update on how fast the U.S. economy grew in early 2025.

- 👟 Earnings from Nike (NKE), Walgreens (WBA), and McCormick (MKC): Key consumer and retail signals.

Friday (June 27):

- 💸 PCE Price Index (May): The Fed’s preferred inflation gauge—tells us how much prices are rising.

- 🧮 Core PCE (May): Same as above, but with food and energy prices removed for a clearer trend.

- 🗣️ Consumer Sentiment (June, Final): Wraps up the month with a read on how Americans feel about their finances.

📬 Share this with a friend — and let them in on the secret. They can subscribe right here.

🔔 Follow us on 𝕏 here.

Disclaimer: Content published by Portfolio Activity is for educational purposes only and does not constitute personalized investment advice or a solicitation to buy or sell any security. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a licensed financial professional before acting on any information provided. Portfolio Activity, its contributors, and affiliates may hold positions in securities mentioned and assume no liability for errors, omissions, or losses arising from use of this material.

Comments